Good morning and welcome back to the land of blinking screens. From my seat, the state of the Trump administration appears to have taken the place of tensions with North Korea this week in terms of what markets are most concerned about. This may be a temporary thing during what is traditionally prime vacation season on Wall Street. So, with volume light and trading desks thinly staffed, we should probably expect volatility to continue for a while.

Since it’s the start of a new week, let’s now focus on our objective review the key market models and indicators and see where things stand. To review, the primary goal of this weekly exercise is to remove any subjective notions one might have in an effort to stay in line with what “is” happening in the markets. So, let’s get started.

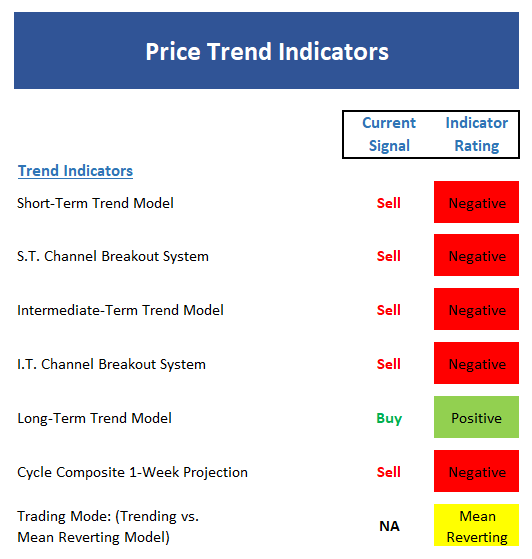

The State of the Trend

We start each week with a look at the “state of the trend.” These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

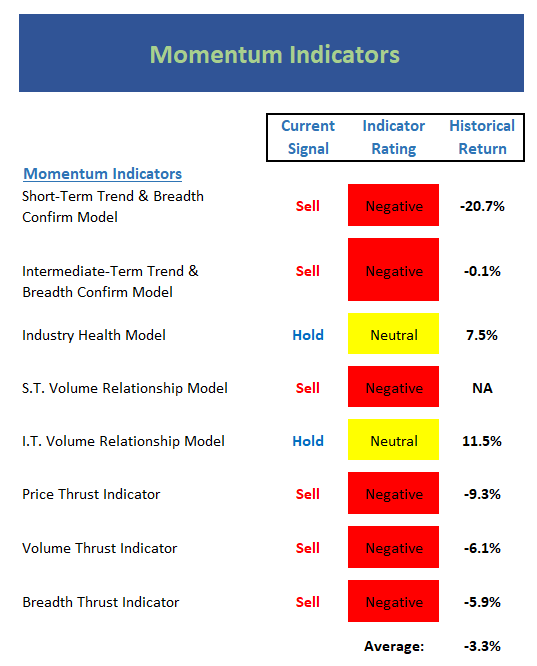

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any “oomph” behind the current trend…

Executive Summary:

Leave A Comment