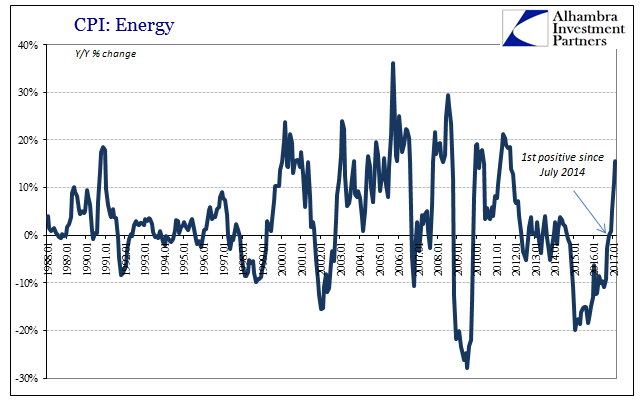

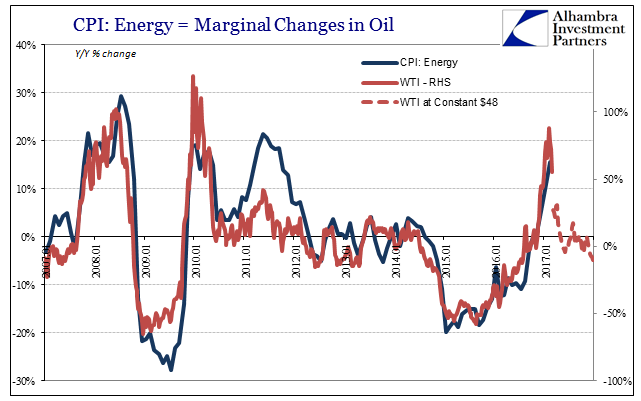

The Consumer Price Index increased 2.74% in February 2017 over February 2016. That was the highest inflation rate registered in this format since February 2012. As has been the case for the past three months, the acceleration of headline inflation is due almost exclusively to the sharp increase in oil prices as compared to the lowest levels last year (base effects). It is the only part of the CPI report which captures anything like it.

The energy price index was up 15.6% year-over-year, compared to an 11.1% increase in January. The gamma of energy and therefore the CPI is already fading, with oil prices having been stuck at $52-$54 during the months of January and February. If WTI remains about where it is now, around $48, the current month (March) will be the last to feature any significant acceleration from oil.

The other parts of the CPI are as they have been consistently throughout. The “core” index, CPI less food and energy, was up 2.2% in February. It was the fifteenth straight month where the core increase was one of 2.1%, 2.2%, or 2.3%. In what is probably the best indication of inflation stripped of energy, the last time the core rate accelerated even slightly was during the second half of 2015.

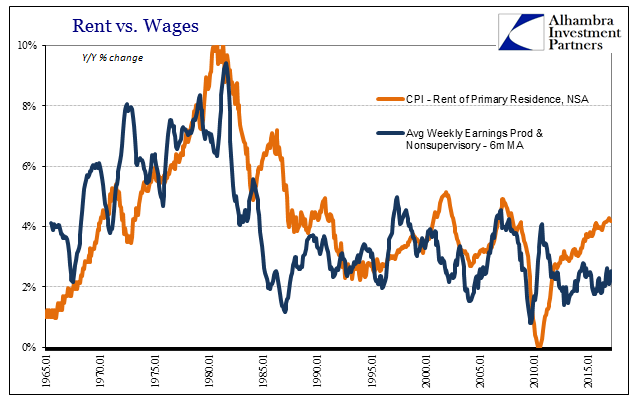

Outside of energy, rising rent prices continue to be the primary plague upon consumer finances. The rent component of the CPI rose 4.2%, the sixteenth time over the past eighteen months where the annual change was 4% or more (and the remaining two months were just less than 4%). At the peak of the housing bubble, rental prices according to the CPI’s version of them increased at a better than 4% for a total of nineteen months to early 2008. In the early 2000’s, it was for twenty-five.

The difference between those prior periods and the current one is wages. Now, unlike before, wages and earnings are growing at about half the rate that rents are. This disparity is usually only found during periods of recession, a painful reminder of the underlying weakness in the real economy and the imbalances that remain.

Leave A Comment