Insider buying decreased significantly last week with insiders buying $154.2 million of stock compared to $540.45 million in the week prior. Selling on the other hand increased with insiders selling $1.06 billion of stock last week compared to $938.04 million in the week prior.

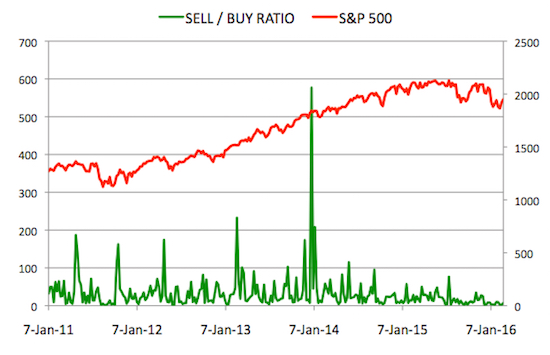

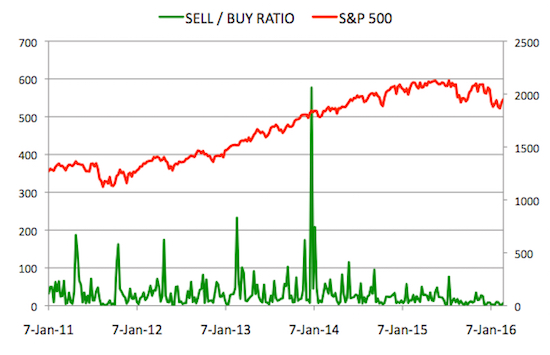

Sell/Buy Ratio: The insider Sell/Buy ratio is calculated by dividing the total insider sales in a given week by total insider purchases that week. The adjusted ratio for last week went up to 6.85. In other words, insiders sold almost 7 times as much stock as they purchased. The Sell/Buy ratio this week compares unfavorably with the prior week, when the ratio stood at 1.74. We are calculating an adjusted ratio by removing transactions by funds and companies and trying as best as possible only to retain information about insiders and 10% owners who are not funds or companies.

Note: As mentioned in the first post in this series, certain industries have their preferred metrics such as same store sales for retailers, funds from operations (FFO) for REITs and revenue per available room (RevPAR) for hotels that provide a better basis for comparison than simple valuation metrics. However metrics like Price/Earnings, Price/Sales and Enterprise Value/EBITDA included below should provide a good starting point for analyzing the majority of stocks.

Notable Insider Buys:

1. Zillow Group, Inc. (Z): $21.01

Director Jay C. Hoag acquired 2,269,337 shares of this real estate information provider, paying $19.98 per share for a total amount of $45.33 million. These shares were purchased indirectly through various Technology Crossover Venture (TCV) funds.

We would have normally skipped this purchase because it is a purchase by a fund but decided to make an exception because of Mr. Hoag’s history of insider purchases.

TCV is a well known venture capital company that mostly invests in private companies but sometimes ventures into public markets. The company first invested in Netflix (NFLX) back in 1999 and Mr. Hoag’s purchase of Netflix shares in May 2012 at prices in the low $70?s (pre-split) were one of the best instances of insider purchases I have seen since I started tracking this data more than 5 years ago. Netflix shares had dropped dramatically before Mr. Hoag’s purchases on news that the company was going to split itself a DVD mailing service called Qwikster and a streaming service. Much to the relief of investors, the company eventually abandoned that plan and the stock eventually went up 10 fold. Unfortunately for TCV, they did not hold through that entire 1,000%+ increase.

Zillow’s class A shares trade under the symbol ZG while the newly issued class C shares trade under the old symbol Z. Based on the three filings that constitute this $45.33 million purchase, TCV purchased both class A and class C shares but acquired nearly 5 times as many C shares as A shares. The footnotes of all three filings indicate that the shares were sold and not purchased but that appears to be an error because both the transaction code and the number of shares owned following the transaction indicate that these were purchases.

Leave A Comment