The overall tenor of news from the big G7 economies continues to be modestly bullish. The EU, continues to grow at a slightly above trend pace, continuing a trend that started in the fourth quarter of 2016. On the other side of the globe, Japan and Australia continue their modest expansions.Canada, which recently raised rates 25 basis points, also shows signs of improvement.

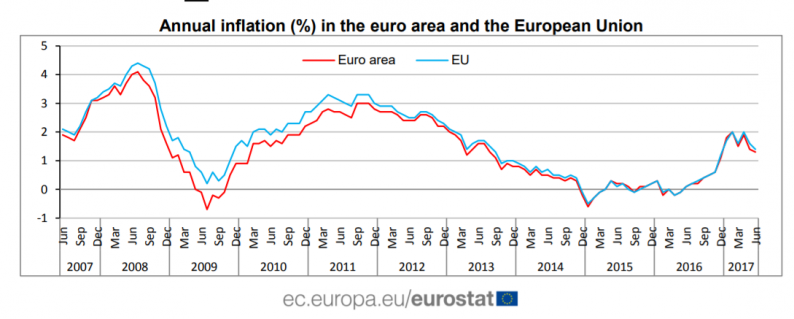

The ECB maintained their current interest rate and asset purchase policy. As for interest rates, they stated that “present levels will remain “well past the horizon of our net asset purchases,” implying an extended period for the current rate level. The bank gave a very upbeat assessment of the EU economy, noting household spending and investment were increasing. In other news, headline CPI inflation was 1.3%; food prices increased 1.4%, while the ex-energy level was 1.2%. The following chart from the release shows that although EU inflation hit 2% earlier this year, it is now moving a bit lower:

As an aside, it’s interesting to note that the EU inflation chart looks remarkably similar to the U.S. inflation chart.

The bank of Japan also maintained their current interest rate and asset purchase program. The bank describes its policy as “yield curve control,” meaning they will purchase Japanese gov’t bonds at a pace to keep 10-year rates at or near 0%. The bank also released their latest economic projections. The most important statement they made was that they believe economic risks are skewed to the downside. This outlook places the bank in a more defensive posture, more likely to maintain stimulus.

The RBA released their latest meeting minutes this week. While household spending was lower in the second quarter, high-frequency indicators pointed to a third quarter pickup. Increased mining activity was the primary cause of increased investment spending and higher corporate profits. A recent uptick in Chinese infrastructure spending contributed to higher terms of trade, which, in turn, also contribute to higher mining sector activity and revenue. Overall, the Australian economy continues to grow at a modest pace.

Leave A Comment