Price inflation increased in the January CPI report and the average hourly earnings from the labor report came in hot. This combination caused economists and analysts to start making projections for inflation to trend higher in 2018. This is just like how investment banks raised their 2018 year end S&P 500 forecasts after stocks rallied in the first 3 weeks of the year. That was laughable because nothing fundamental changed. The only thing that happened is stocks moved up. Forecasters were deathly afraid of being bearish on stocks for the year, so they changed with the market. As you can see, many forecasts tell you more about the past than they tell you about the future.

The February CPI report and labor report were the opposite of the January reports as the average hourly earnings growth decelerated from 2.8% to 2.6%. The month over month CPI was up 0.2% which was much less than January which saw 0.5% growth. The core CPI was up 1.8%. It’s questionable if the Fed should be raising rates so quickly if the core CPI isn’t at the Fed’s target of 2%. Keep in mind, that the Fed’s favorite inflation metric is core PCE which is usually lower than the core CPI, meaning inflation isn’t at the target.

Not Just Wireless Seeing Disinflation

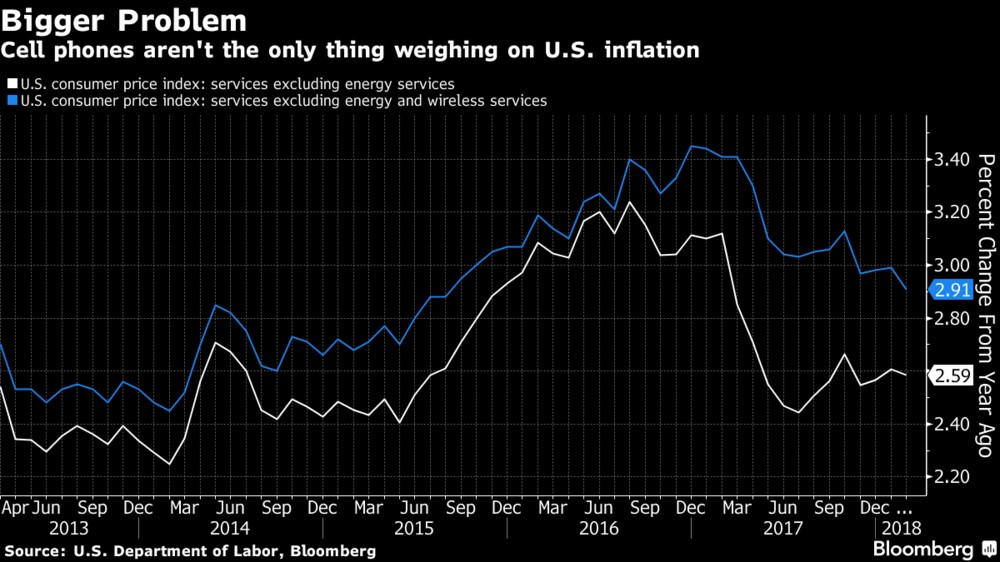

Last year, Yellen raised rates 3 times despite low inflation because she said wireless price declines were the temporary catalyst for the disinflation. However, the results don’t look so temporary. As you can see from the chart below, the inflation excluding wireless and energy is higher than the inflation which only excludes energy because wireless prices still are weighing on inflation. The difference is 32 basis points.

Wireless Disinflation Still A Thing

Even though the two metrics have merged a bit from 2017, the trend isn’t what Yellen predicted. She stated the metrics should converge because the inflation in wireless services would increase, but instead the inflation in the other products have come down to where wireless is at. The disinflation may not have been as transitory as Yellen expected. When growth and inflation miss Fed forecasts, the Fed becomes too hawkish.

Leave A Comment