Written by Mark Melin

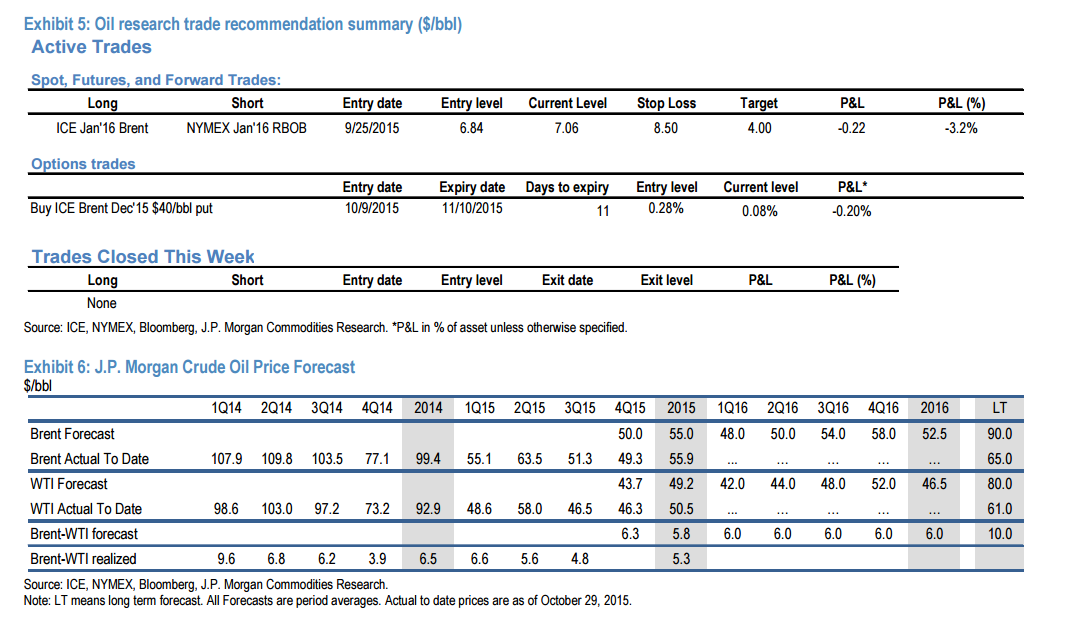

Oil ended October much as it started September, a JPMorgan research piece noted. But be patient, the letter advises. The price of oil is headed lower.

JPMorgan: Ignore the noise in the oil market

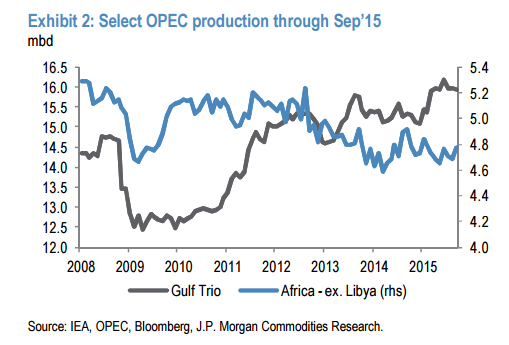

The “muted” weekly closing oil price changes conceal an alter ego of high intraday volatility that markets have experienced over the past few weeks, the report noted. Research analysts David Martin and Upadhi Kabra think the strong oil rally in early October faded over the balance of the month with oversupply remaining the dominant market the price outlook, which was confirmed by EIA monthly data that confirmed US production continues to decline.

Several headlines have provided both false signals while others have tempted market participants. When the US government agreed to sell 58 billion barrels of crude from its SPR reserve inventories during 2018 to 2025, with potential to increase the selling to 100 million barrels, this news was noise. Likewise, a crude oil swap agreement with Mexico that also made news was market noise.

JPMorgan: An oil deal might take time

There is a possibility for a deal between OPEC members that is worth considering. If it is consummated, markets would likely see the re-imposition of production targets presumably in order to lift oil prices. Likewise, the report noted the “tantalizing prospect of a broader agreement was mooted ahead of last week’s technical discussions between Russia and OPEC members.” Despite the muted response, “OPEC policy shifts of this nature would be a game-changer for our price outlook through end-2016,” the report projected.

Beyond the internal politics of OPEC, the report notes that the regional tensions in Syria that place Saudi Arabia and its Sunni allies at odds with Russia and Iran, could cause problems. Despite there being sufficient economic rationale for OPEC to reach an agreement, “political constraints may inhibit it,” the report noted.

Leave A Comment