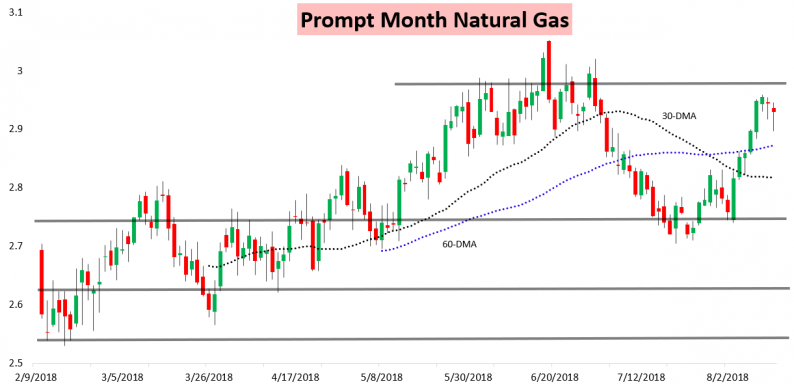

The September natural gas contract settled down around a cent and a half on the day after prices sold off more heavily early this morning and bounced through the trading session to minimize losses.

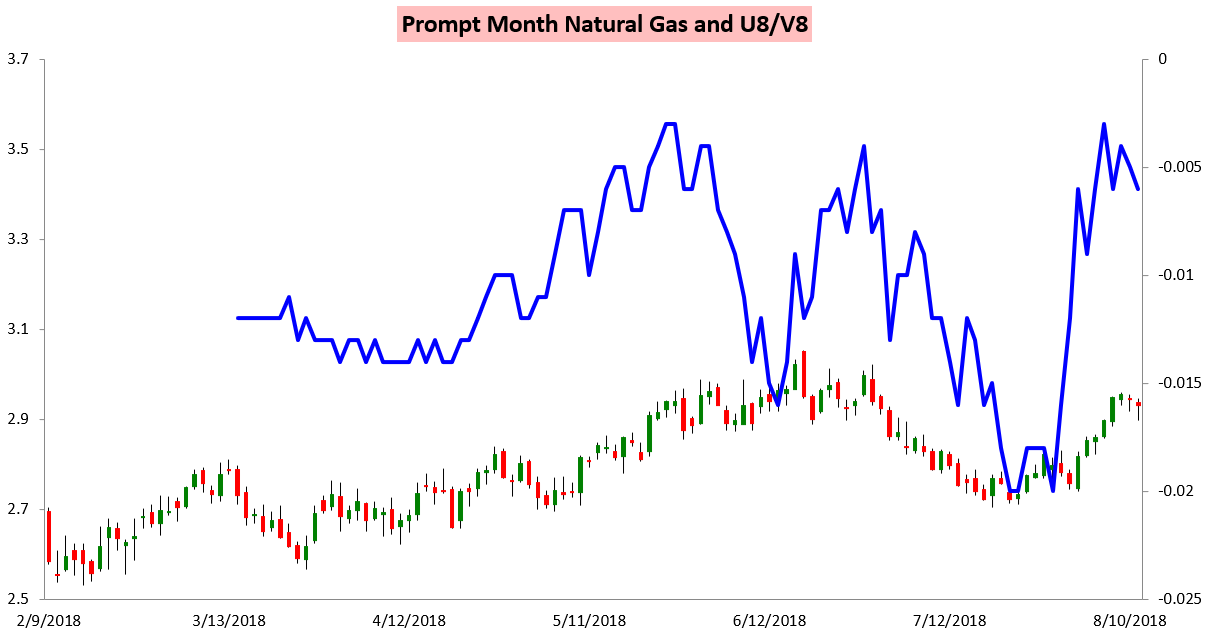

Later contracts were certainly more firm on the day too compared to the September contract, which was the weakest.

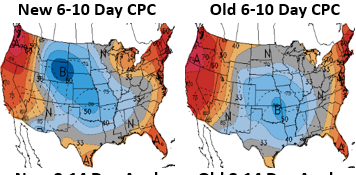

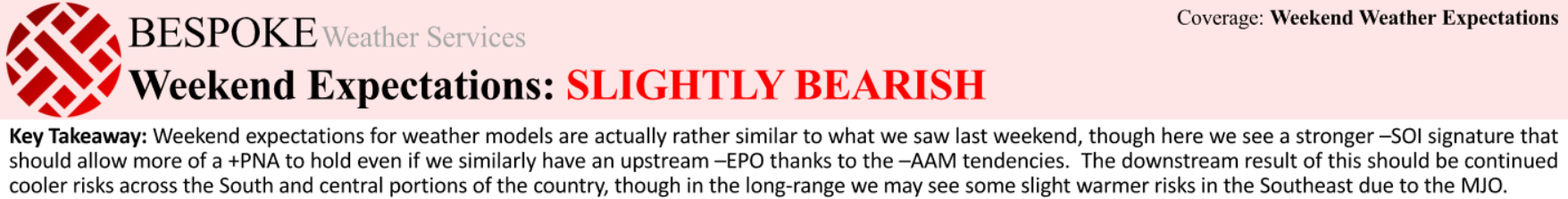

Expectations that the middle of the country cools in the 6-10 and 11-15 Day time periods certainly hit the front of the strip. Climate Prediction Center forecasts increased the confidence in cooler risks in the 6-10 Day time period this afternoon.

This fit well with our Weekend Expectations portion of our Pre-Close Update on Friday, where we warned clients to expect cooler trends to persist across the middle of the country with some more heat possible across the Southeast.

These trends played out over the weekend and seemed to hit prices today, with the September/October U/V spread decreasing a bit as well.

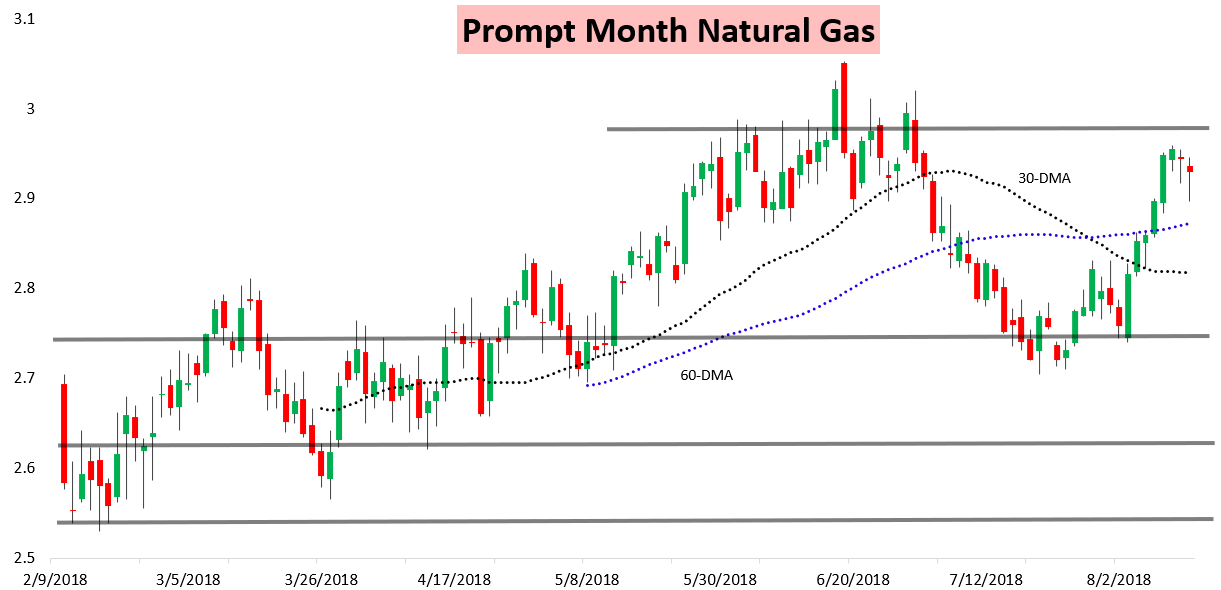

Our Morning Update warned that $2.9 support was at risk of being broken today, but any break should not be sustained or hold. Sure enough, the September contract early this morning very briefly moved below the $2.9 level before rallying through the morning session to make it back near flat.

Meanwhile, storage concerns linger from last week, where we saw yet another very lean injection. We got the first hard data for the upcoming EIA print with Dominion Transmission announcing a build of just 7 bcf, the smallest since early May.

Leave A Comment