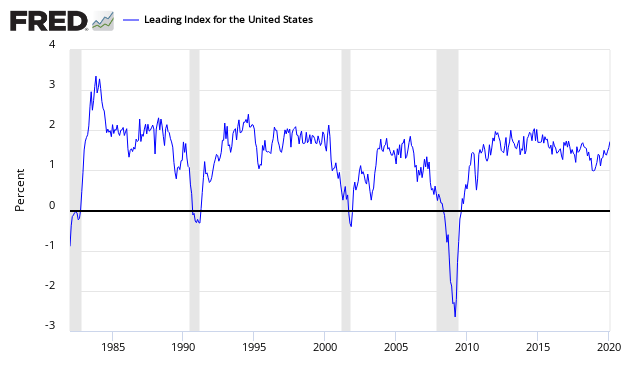

This leading index continues to be recalculated (what good is a leading index whose history continues to be recalculated?) – and continues to forecast stable but relatively weak growth into 2016. A review of all major leading indicators follows – and no leading index is particularily strong.

Note that this index is not accurate in real time as it is subject to backward revision, Per the Philly Fed:

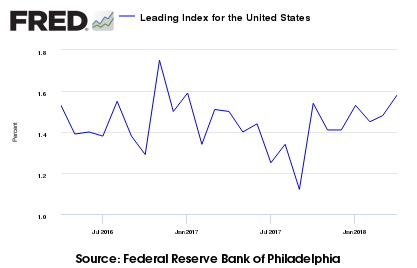

The Federal Reserve Bank of Philadelphia has released the leading indexes for the 50 states for September 2015. The indexes are a six-month forecast of the state coincident indexes (also released by the Bank). Forty-seven state coincident indexes are projected to grow over the next six months, while three are projected to decrease. For comparison purposes, the Philadelphia Fed has also developed a similar leading index for its U.S. coincident index, which is projected to grow 1.3 percent over the next six months.

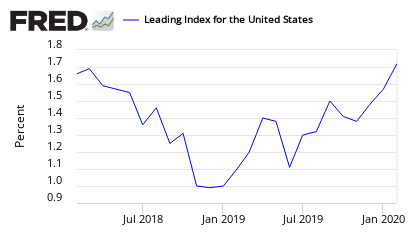

[click on graphic to enlarge]

Index Values Over the Last 12 Months

This index has been noisy, but remains well above 1%, and is about mid-range of the values seen since the end of the Great Recession.

The Other Leading Indicators

The leading indicators are to a large extent monetary based. Econintersect‘s primary worry in using monetary based methodologies to forecast the economy is the current extraordinary monetary policy which may (or may not) be affecting historical relationships. This will only be known at some point in the future. Econintersect does not use any portion of the leading indicators in its economic index. All leading indices in this post look ahead six months – and are all subject to backward revision.

Chemical Activity Barometer (CAB) – The CAB is an exception to the other leading indices as it leads the economy by two to fourteen months, with an average lead of eight months. The CAB is a composite index which comprises indicators drawn from a range of chemicals and sectors. Its relatively new index has been remarkably accurate when the data has been back-fitted, however – its real time performance is unknown – you can read more here. A value above zero is suggesting the economy is expanding. Econintersect‘s analysis of this index is [here].

Leave A Comment