Lockheed Martin Corp. LMT reported third-quarter 2018 earnings of $5.14 per share, beating the Zacks Consensus Estimate of $4.32 by 19%. The bottom line also improved 54.8% from the year-ago quarter’s figure of $3.32.

Operational Highlights

In the reported quarter, total revenues came in at $14.32 billion, which surpassed the Zacks Consensus Estimate of $13.15 billion by 8.9%.

Moreover, the company’s revenues increased 16% from $12.34 billion a year ago. Notably, all segments registered year-over-year growth in sales.

Backlog

Lockheed Martin ended the third quarter (on Sep 30, 2018) with $109.2 billion in backlog, up 4% from $105 billion at the end of second-quarter 2018. Of this, the Aeronautics segment accounted for $36.77 billion, while Rotary and Mission Systems contributed $29.21 billion. Also, $23.28 billion came from Space Systems and $19.93 billion from the Missiles and Fire Control segment.

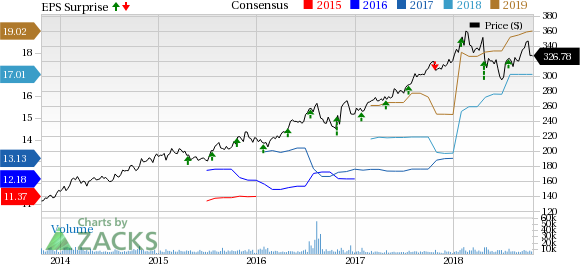

Lockheed Martin Corporation Price, Consensus and EPS Surprise

Lockheed Martin Corporation Price, Consensus and EPS Surprise | Lockheed Martin Corporation Quote

Segmental Performance

Aeronautics: Sales increased 19.6% year over year to $5.64 billion, primarily driven by higher net sales from the F-35, F-16 and F-22 programs.

Operating profit advanced 17% year over year to $600 million, while operating margin contracted 30 basis points (bps) to 10.6%.

Missiles and Fire Control: Quarterly sales rose 16.1% year over year to $2.27 billion owing to higher sales for tactical and strike missiles programs as well as sensors and global sustainment programs.

While operating profit increased 11.4% year over year to $332 million, operating margin contracted 60 bps to 14.6%.

Rotary and Mission Systems: Quarterly sales of $3.85 billion increased 14.4% from the prior-year quarter, courtesy of higher sales for integrated warfare systems and sensors (IWSS) programs as well as C4ISR programs. Also higher sales for Sikorsky helicopter programs drove the segment’s top line.

Leave A Comment