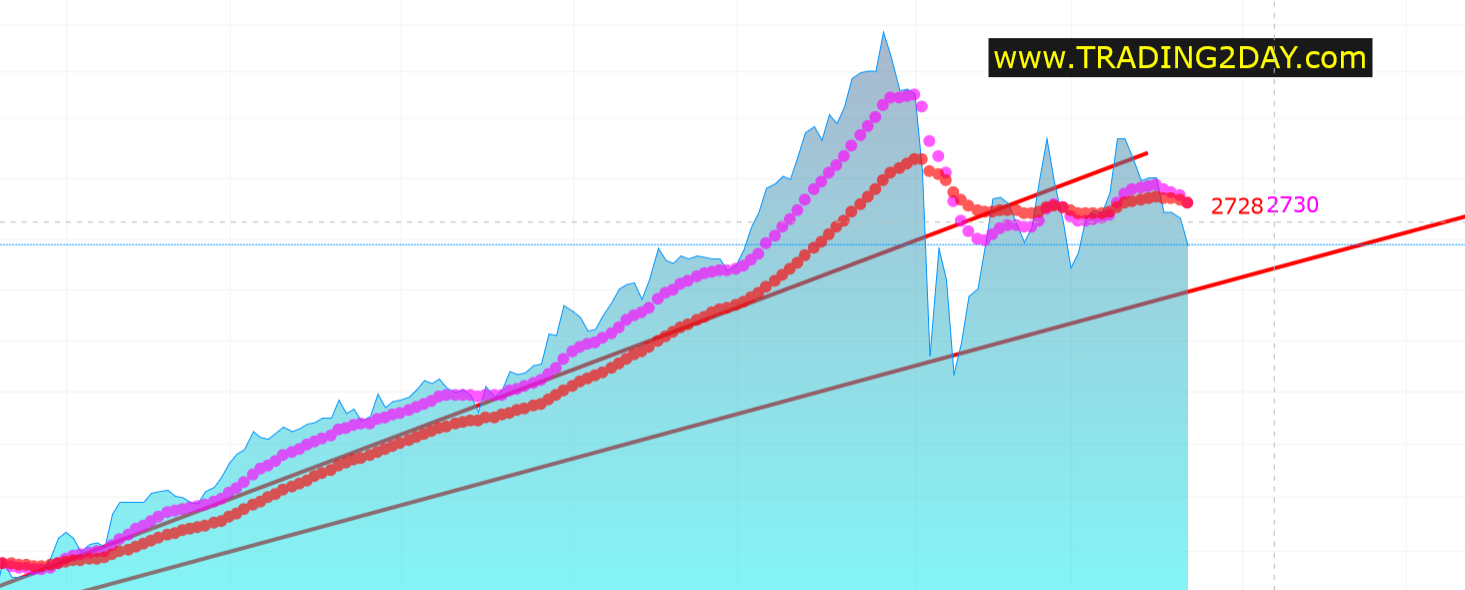

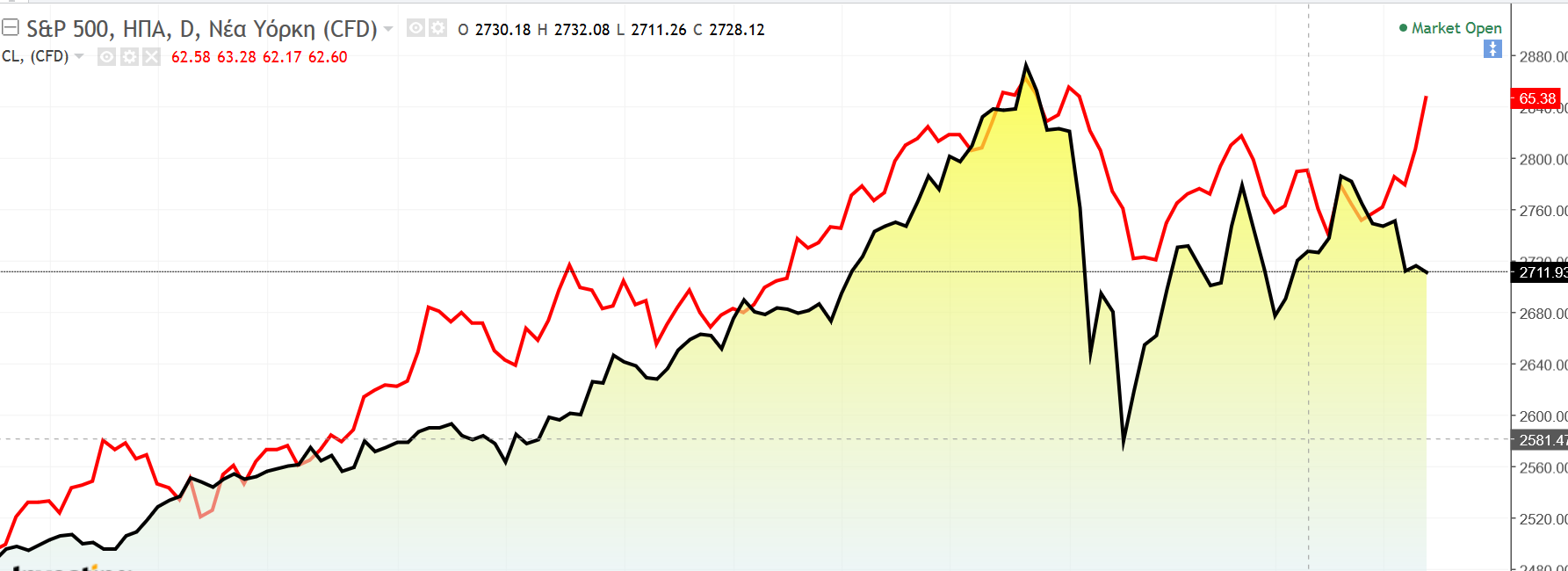

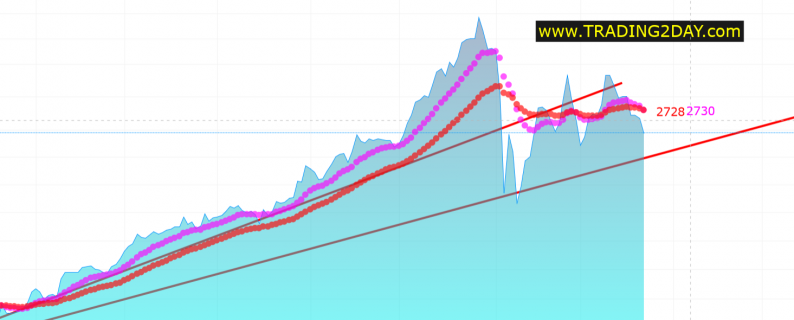

For some time now Oil has been strongly positively correlated to SPX. I could even say that Oil could be leading SPX price. I have been a dip buyer in SPX around 2720 but price has not made any significant progress to my short-term target of 2800. Instead my automated system has turned bearish.

What if my analysis for a bounce towards 2800 in SPX is wrong? That is why I have decided to short Oil at $65.21 yesterday

Short oil @65.21 as a hedge to my longs in spx dax

— Alexandros Yfantis (@alexanderYf) March 21, 2018

mainly as a hedge to my long index position.

The ideal scenario would be for Oil to pull back and SPX to rise so that both meet in the middle. I’m very curious as to how this relationship will unfold over the coming days. I do not like giving too much weight to correlations as I prefer to see each asset separately, but in this case I may make an exception for a few days. With Oil price now at $64.74 and SPX at 2695 this hedge seems to be working. Not ideally…but it works.

Leave A Comment