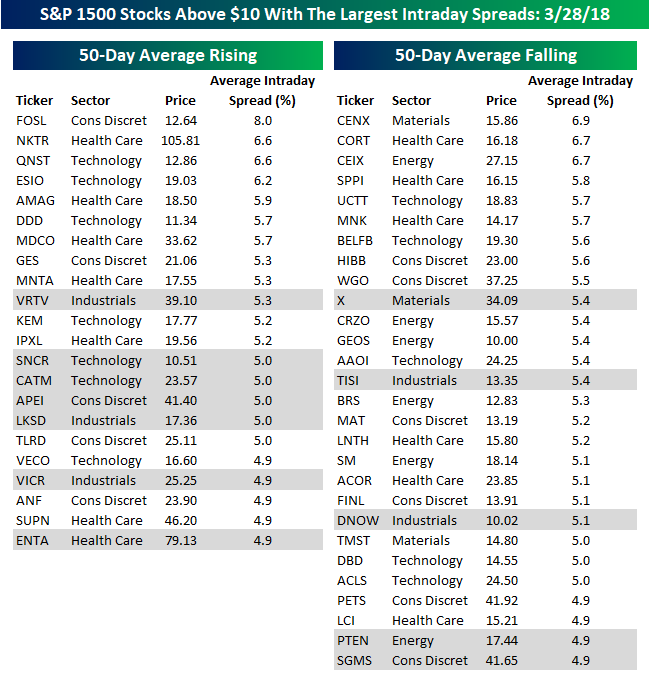

For traders with a short-term time horizon looking for big moves, we have updated our list of the S&P 1500 stocks trading above $10 that have the largest intraday high-low ranges (based on the average percent spread between the intraday high and low over the last 50 days). The stocks are grouped based on whether they have a rising or falling 50-day moving average (DMA), and names highlighted in gray are new to the list this month.

With volatility in the market surging, the most volatile stocks are also becoming increasingly volatile. In our last update back on 2/14, just 26 of the 50 most volatile stocks had average daily ranges of 5% or more. As of yesterday’s close that number had increased to 41.Also, the percentage of stocks with rising moving averages has diminished.On 2/14, the 50 most volatile stocks were evenly split between stocks with rising and falling 50-DMAs.In this month’s update, though, the percentage of stocks in downtrends (falling 50-DMAs) outnumbers uptrends (rising 50-DMAs) 28 to 22.

Of the 50 stocks listed below, Fossil is the most volatile with an average daily range of 8.0%. However, because it trades at just over $12 per share, that 8% daily range doesn’t really translate into much in terms of dollars.Right below FOSL, though, is Nektar Therapeutics (NKTR). With a share price of around $106 per share and an average daily range of 6.6%, NKTR sees a typical high/low spread of over $7.

In terms of sector representation, stocks from just six of the eleven sectors are on this month’s list.Leading the way with 13 stocks is Health Care, which is followed by Technology (12) and Consumer Discretionary (11).The five sectors with no stocks making the list are Consumer Staples, Financials, Real Estate, Telecom Services, and Utilities.

Leave A Comment