A rising number of investors are anxious about the “bull market in everything”, but the markets are calm, based on rolling 90-day volatility (standard deviation). It may be the calm before the storm, although research on volatility clustering suggests that the tranquil times can roll on for longer than expected. The tide will turn eventually, of course, and perhaps soon, but the rear-view mirror at the moment shows that the landscape is unusually serene across the board for the major asset classes in recent history, based on a set of exchange-traded products via rolling 90-day standard deviation of one-day percentage returns.

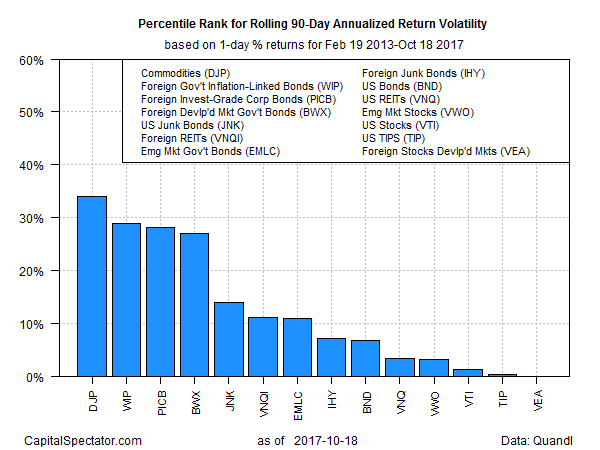

Ranking markets by percentile rank for the historical period since early 2013 reveals that foreign stocks in developed markets are the low-vol leader at the moment (calculated as the standard deviation of one-day percentage returns). Based on that window, Vanguard FTSE Developed Markets (VEA)’s 90-day vol is at its lowest point through yesterday’s close (Oct. 18) – just a hair above the zero percentile rank.

At the opposite extreme: broadly defined commodities. The 90-day vol rank for iPath Bloomberg Commodity (DJP) is currently at the 34th percentile. That’s relatively high, compared with the rest of the field, but by the ETN’s history over the last several year’s it’s clear that trading activity has become rather peaceful of late.

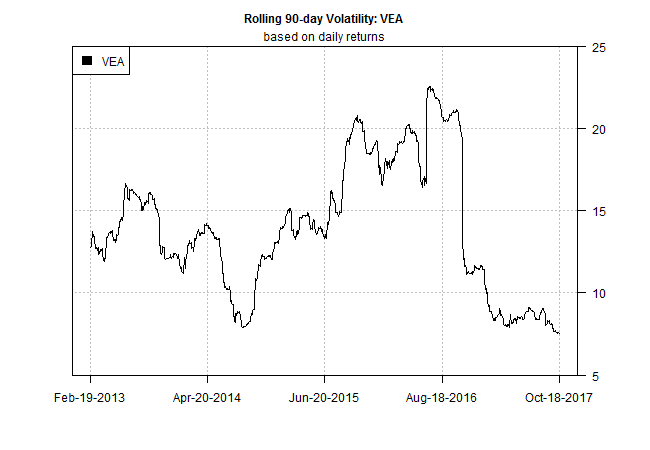

For additional context, let’s focus on the rolling volatility for a handful of funds, starting with the calmest portfolio in the bunch: Vanguard FTSE Developed Markets. As the chart below shows, volatility for the fund has collapsed over the past year.

Commodities, on the other hand, are the high-vol leader these days via iPath Bloomberg Commodity. That’s not surprising, although what passes for volatility in this corner has fallen sharply in recent history.

Finally, let’s profile the US stock market’s vol history of late. Here, too, the main event is a dramatic slide in volatility, based on Vanguard Total Stock Market (VTI). The fund’s trailing 90-day vol isn’t at its lowest level in recent years, but it’s close: the current vol reading is roughly at the 1% percentile rank since 2013.

Leave A Comment