The lumber price has traded pretty much exactly as outlined in analysis, titled Lumber Lambasted and Lumber Looking Lousy, produced in May 2015 and September 2015 respectively.

I expect price to continue to trade as outlined in those analyses but it doesn’t hurt to update the picture so let’s do just that, beginning with the monthly chart.

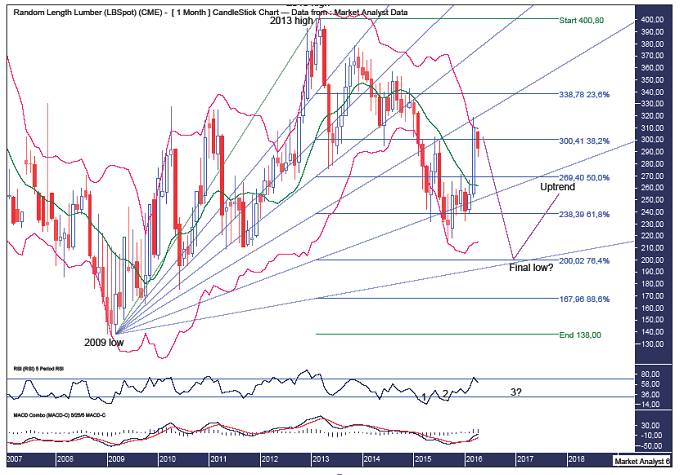

LUMBER MONTHLY CHART

The Bollinger Bands show price has bounced right back up to the upper band and I expect resistance to come in here and send price right back down.

The Fibonacci Fan drawn from the 2009 low to 2013 high shows price is back up at resistance from the 61.8% angle. I favour price to fall from here with the expectation of the final low being down around support from the 88.6% angle.

I have added Fibonacci retracement levels of the move up from the 2009 low to 2013 high and, as laid out previously, I am looking for the final low to get down to at least the 76.4% level which stands at $200.

The RSI shows a bullish divergence in place while a new price low would likely set up a triple bullish divergence.

The MACD indicator is bullish but the averages have diverged a bit and a move back down would rectify that.

LUMBER WEEKLY CHART

As outlined previously, we are following a 5 point broadening low and I believe the point 4 high to now be in place at the $319 quote. Now for the final move down to put in a point 5 low.

The Bollinger Bands show price has left the upper band although I think price will have one last lash at it before the downtrend really gets going.

The Fibonacci Fan drawn from the August 2014 high to point 1 low shows some very nice symmetry with price. The point 2 high was at resistance from the 61.8% angle, the point 3 low was at support from the 23.6% angle while this current point 4 high was just below the 88.6% angle.

The RSI was oversold and now looks headed back down while the MACD indicator looks to be turning back down.

Let’s finish up the analysis by looking in close with the daily chart.

Leave A Comment