The Census Bureau’s Advance Retail Sales Report for March was released this morning. Headline sales came in at 0.6% month-over-month to one decimal and was above the Investing.com consensus of 0.4%. Core sales (ex Autos) came in at 0.2% MoM. January and February figures were revised.

Here is the introduction from today’s report:

Advance estimates of U.S. retail and food services sales for March 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $494.6 billion, an increase of 0.6 percent (±0.5 percent) from the previous month, and 4.5 percent (±0.5 percent) above March 2017. Total sales for the January 2018 through March 2018 period were up 4.1 percent (±0.5 percent) from the same period a year ago. The January 2018 to February 2018 percent change was unrevised from down 0.1 percent (±0.2 percent)*.

Retail trade sales were up 0.6 percent (±0.5 percent) from February 2018, and 4.7 percent (±0.5 percent) above last year. Gasoline Stations were up 9.7 percent (±1.6 percent) from March 2017, while Nonstore Retailers were up 9.7 percent (±1.4 percent) from last year. [view full report]

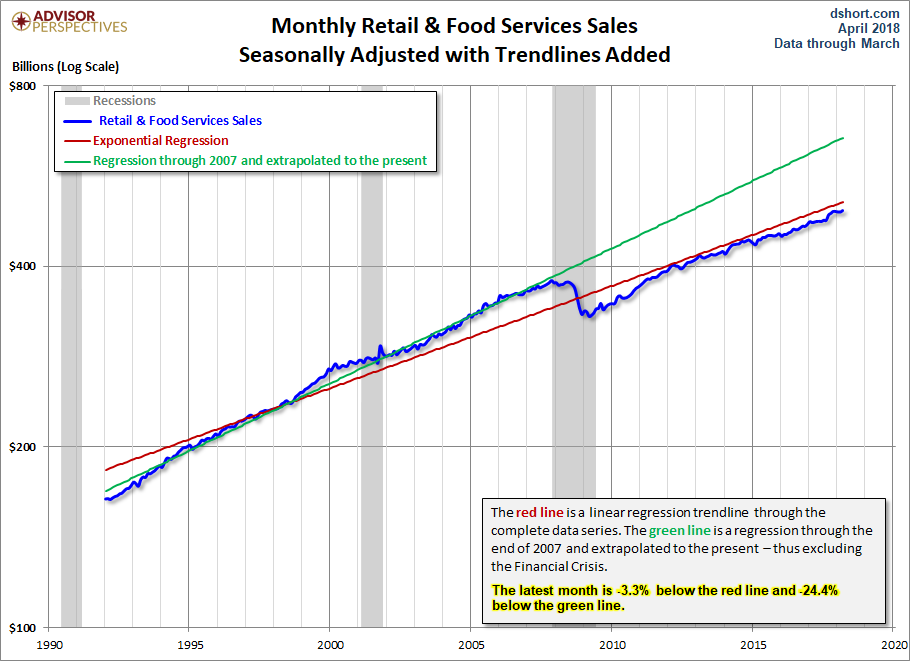

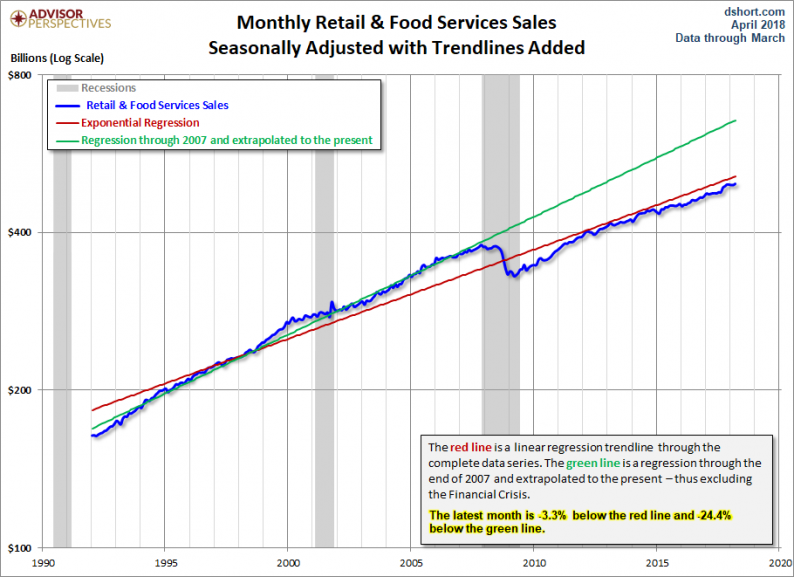

The chart below is a log-scale snapshot of retail sales since the early 1990s. The two exponential regressions through the data help us to evaluate the long-term trend of this key economic indicator.

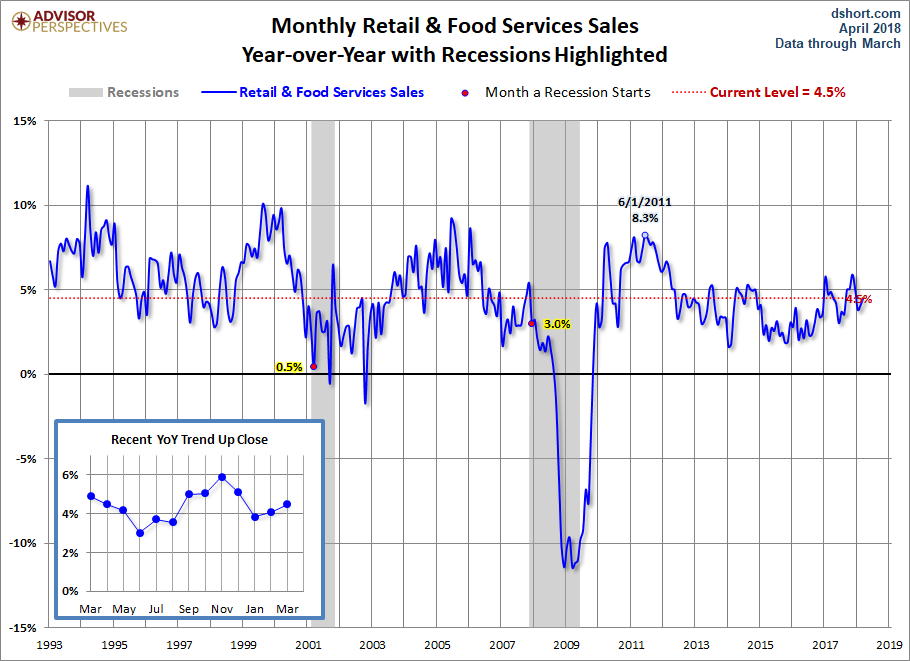

The year-over-year percent change provides another perspective on the historical trend. Here is the headline series.

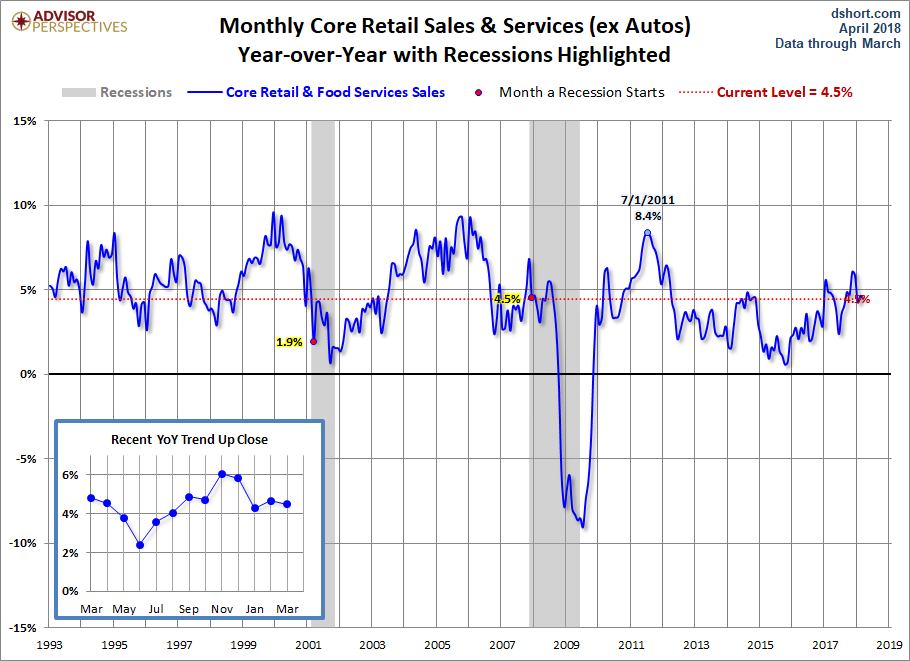

Core Sales

Here is the year-over-year version of Core Retail Sales.

“Control” Purchases

The next two charts illustrate retail sales “Control” purchases, which is an even more “Core” view of retail sales. This series excludes Motor Vehicles & Parts, Gasoline, Building Materials as well as Food Services & Drinking Places. The popular financial press typically ignores this series, but it a more consistent and reliable reading of the economy.

Leave A Comment