The Fed funds rate is a hotly debated topic because it’s the main policy tool the Fed uses. There is economic data which can be interpreted to support every argument. Furthermore, after the metrics are taken into account, the goals are subject to interpretation. Just because the core inflation rate goes above 2%, doesn’t mean the Fed needs to hike rates, as we have previously discussed. The Fed could determine that its mandate of creating stable prices is hit when the core inflation is 3%, as an example.

We’ve seen the Fed ignore the data in 2017 because it felt the decline in inflation was transitory. The entire cycle has been confusing if you look at GDP growth. The average real GDP growth during QE and zero percent interest rates was 2.2% and the average GDP growth during the 5 rate hikes and no QE has been 2.1%. This makes it look like the Fed ignores the strength of the economy when setting policy.

Because it can appear policy and the data aren’t related, the market sometimes overreacts to guidance. For example, the stock market sold off after Powell’s Congressional testimony on February 27th because it felt he was slightly hawkish. Fed policy appears to be impacted by the market and forward guidance. Sometimes the FOMC moves the Fed fund futures and sometimes the market causes the Fed to change its tune.

Price Level Targeting Still Has A 0% Fed Funds Rate

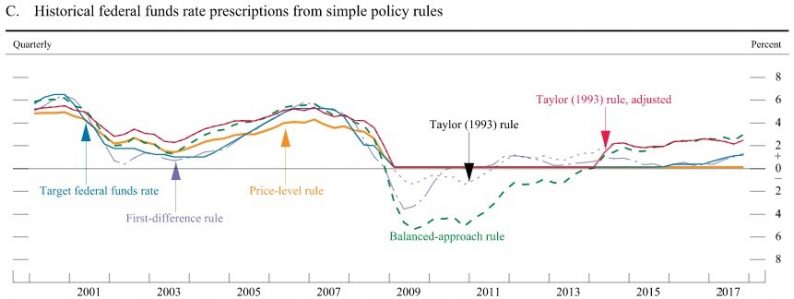

The chart below shows how the Fed funds rate would have looked under various policy rules.

Various Rules Applied To The Fed Funds Rate

In a previously discussed, we discussed price level targeting, which is when the Fed looks at the average inflation over time to come up with policy. For example, if inflation is below 2% for a few years, the Fed will allow inflation to go above 2% for a few years. This policy is very dovish because it essentially allows the Fed to ignore inflation because it has been below the target for most of this expansion. There could be a few years of 3% inflation without a problem. This is why the yellow line in the chart above, which represents that policy, has the Fed funds rate at 0%. It’s interesting to see discussions of this in 2018 because the Fed is already far away from that prescription.

Leave A Comment