Yesterday I noted that the frogs of Wall Street linger in the boiling pot because they are under the delusion that stocks are cheap based on the sell-side hockey sticks that always show $135 per share of S&P earnings and a 15X multiple in the next year ahead. Besides that, should anything go awry with the economy, Washington purportedly stands ready to bail-out the stock market with a new round of fiscal stimulus after the election.

The latter delusion brings to mind what might be called the “CBO hockey stick”, which is a fiscal fantasy so unhinged from reality as to make the Wall Street stock analysts look like models of sobriety by comparison. To wit, CBO’s latest 10-year budget projection assumes that the US economy will hit full employment next year, and remain there with nary a bump or recession in sight through September 2026, at least.

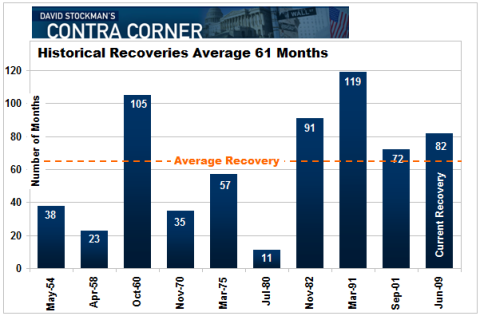

Well, now. Don’t bother to say Rosy Scenario move over because the arithmetic of CBO’s fantasy speaks for itself. That is, it is advising Washington to relax——we are heading for 207 straight months without a recession. And not in the next world, but this.

Since that’s roughly double the longest expansion on record its worthwhile to recall what’s changed since that one-of-a-kind expansion started in March 1991. For starters, the China export tsunami had not even commenced. Nor had the US economy been hollowed out by the massive off-shoring of breadwinner jobs that has resulted from the Fed’s bubble finance policies of the last two decades.

Thus, what had been nearly 25 million goods-producing jobs at the start of the 119 month-long 1990s expansion has been reduced to only 19.5 million today.

Even when you throw in the ostensible growing number of full-time, full-pay jobs in the white collar professions and service industries, the story is similar. There has been no growth of breadwinner jobs since the 1990’s expansion ended in the dotcom bust at the turn of the century.

Leave A Comment