The Australian dollar has dropped by more than 5% against the dollar. The drop is attributed to a hawkish Federal Reserve that is likely to raise rates by four times this year. The Australian economy has also suffered minor shocks this year especially with the falling commodity prices and a challenging housing market.

Today, the Australian dollar is rising against the US dollar after the Reserve Bank of Australia (RBA) released the minutes for the recent monetary policy meeting. The minutes were similar to those released after the previous meetings. The officials were bullish about the Australian economy, which they expect will continue. They were however concerned about the housing markets, with the concerns of the falling prices in Melbourne and Sydney. The number of building approvals too were falling. There was also concerns about the prolonged drought in New South Wales and south Queensland.

Yesterday, the RBA bank governor, Dr. Lowe told Australians to get ready for a rate hike. In a statement, he said that the economy had strengthened, which means that the next rate decision will likely be in the upside. The RBA has not made a rate hike in the past 8 years.

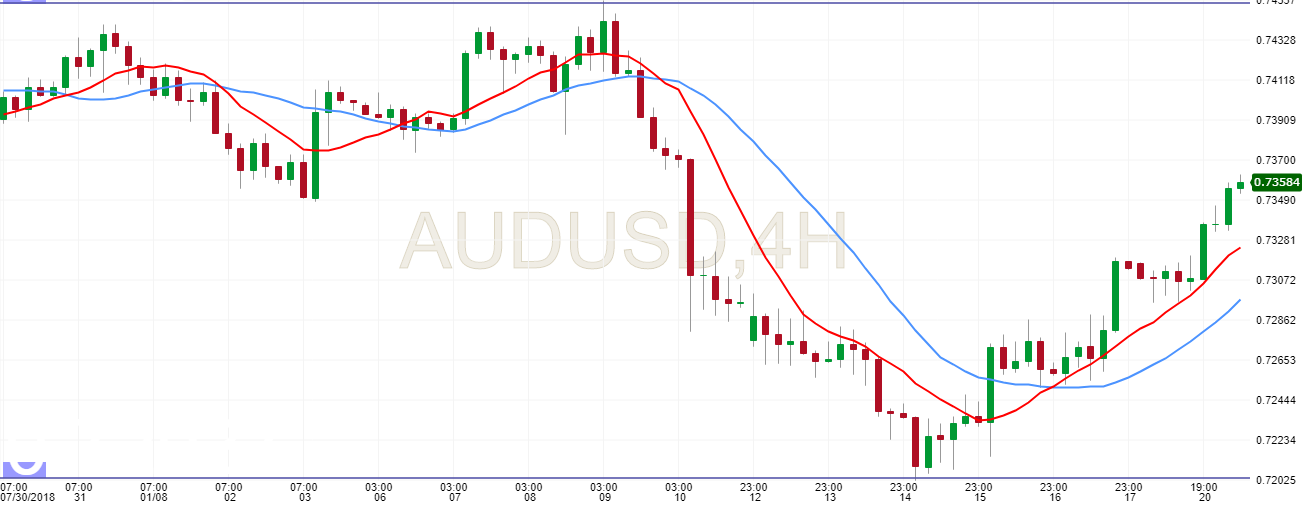

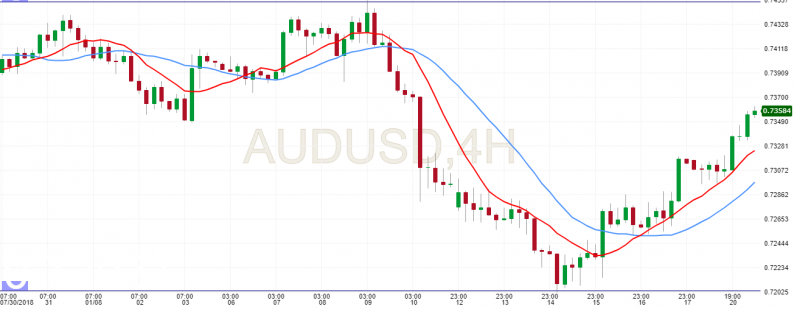

The AUD/USD pair is trading at 0.7360, which is the highest level in almost two weeks. On the four-hour chart below, the pair is forming a cup and handle pattern. This means that there is a likelihood that the upward momentum will continue until the pair hits the 0.7450 level. After this, the pair will likely retrace and form a handle pattern.

Leave A Comment