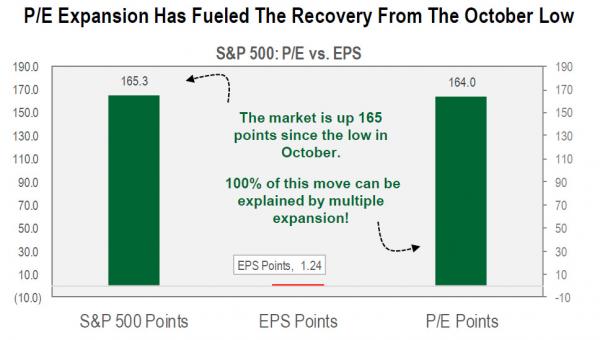

The reason why moments ago we showed a chart demonstrating that all of the surge in the S&P500 from the October lows can be explained with multiple expansion…

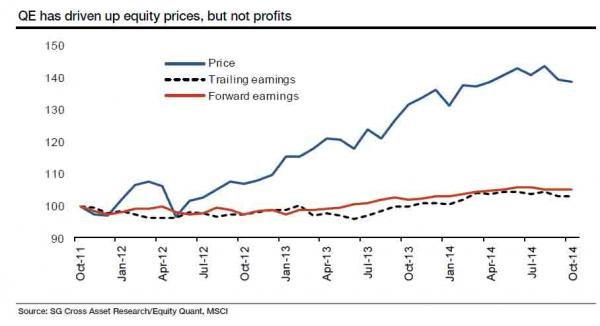

… Is that in a world in which there is no more multiple-expansion – which is merely hope of cheap and easy money – and where the S&P has to grow solely on the back of EPS growth, there would be no all time high S&P, and now relentless diagonal increase in the nominal value of stocks. This is also the basis behind the chart that “amazes” SocGen how the Fed has broken the market.

Which begs the question: will P/E multiple expansion, which at last check was just about 19x on a GAAP basis, continue, and will it hit David Tepper’s mythical “20X”, or are the days of growth pulled from the future over?

Well, according to Goldman’s chief strategist David Kostin, who initially had forecast a 1900 price target on the S&P500 for year end 2014 only to boost it to 2050 in the summer, the days of multiple expansion are now over. As a result, Kostin suggests that the best the S&P will do in 2015, which trading at 2052 at last check is is already above his year end target, is rise a modest 5% to 2100.

Here is David Kostin’s take:

Leave A Comment