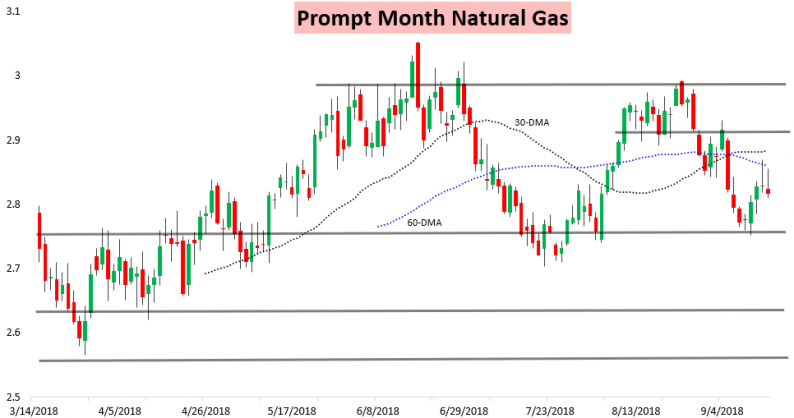

Despite a hurricane barreling towards the Southeast and a Thursday EIA print, it was a relatively slow day in the natural gas market, with a 5.1-cent range for the prompt month October contract. An in-line EIA print that confirmed recent loosening over the Labor Day holiday helped the October contract decline about half a percent on the day.

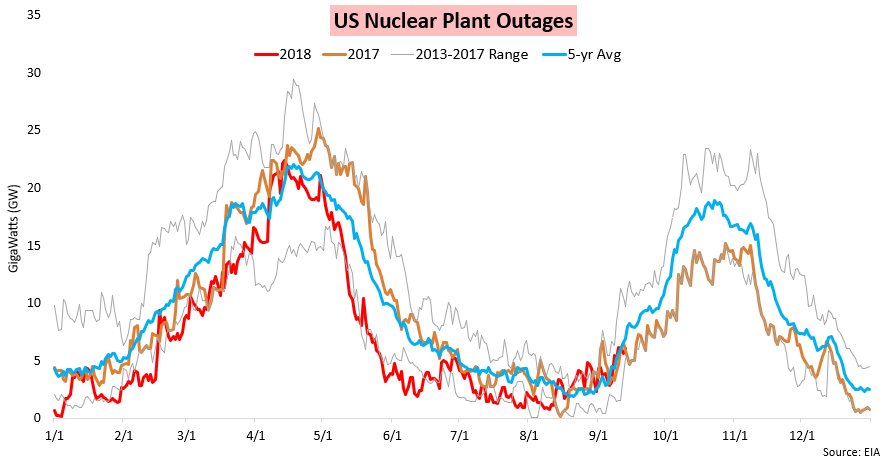

Meanwhile, as Bespoke’s Chief Weather and Energy Analyst I was on Bloomberg TV this morning breaking down the impacts of Hurricane Florence on energy markets. I generally broke down the potential for nuclear and natural gas plant outages in the Southeast as well as energy demand destruction from power outages and cooler weather. Those nuclear outages ticked back up today as plants began to close in the Southeast.

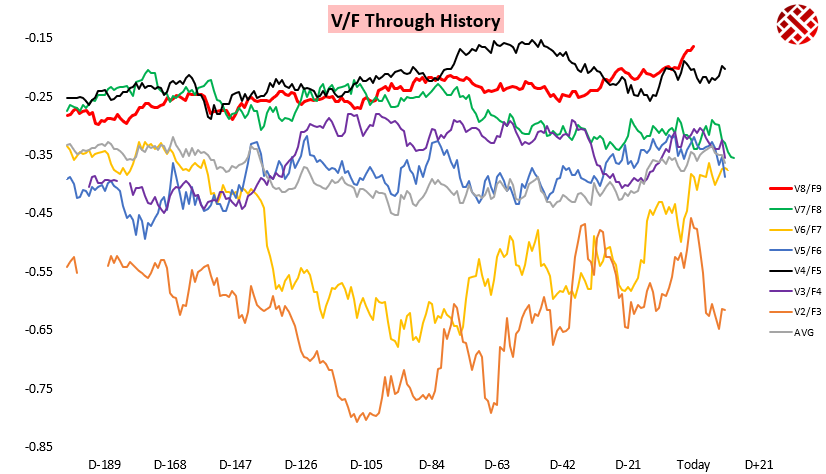

I also focused on the role that tighter weather-adjusted power burns this week played in helping natural gas prices rally before the demand destruction of Florence arrived. This has helped to contribute to strong cash prices and an October/November V/X spread that has only continued to run.

The V/F October/January spread looks similar, sitting now far outside its historical range ahead of October expiry.

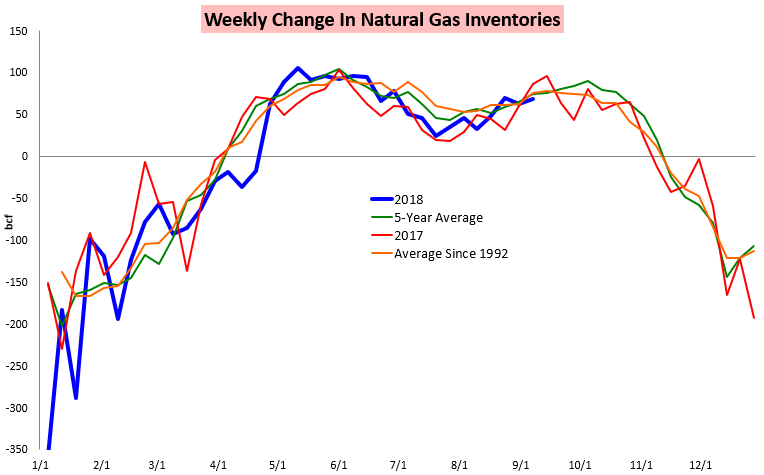

Yet an in-line EIA print seemed to get the better of gas today, pulling it back from its high and helping another rally fail. The EIA announced that 69 bcf of natural gas was injected into storage last week, just 1 bcf above our estimate.

Leave A Comment