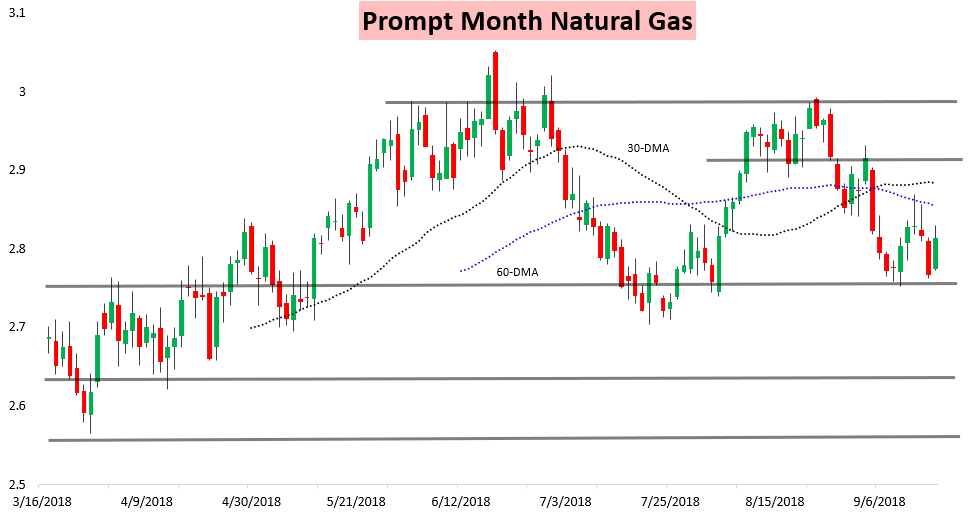

The natural gas market rallied significantly on strong cash prices today as the remnants of Florence moved across the Ohio River Valley and gas demand did not fall off quite as much as some feared from the storm.

The role of very strong cash prices was clearly evident along the strip.

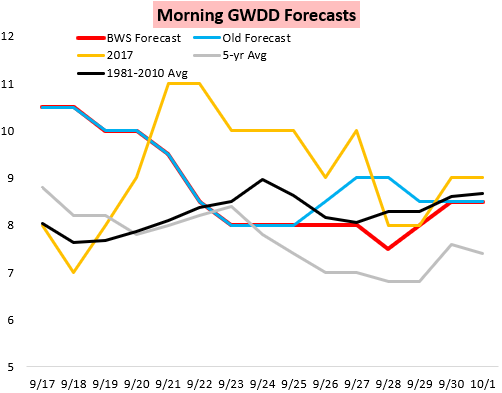

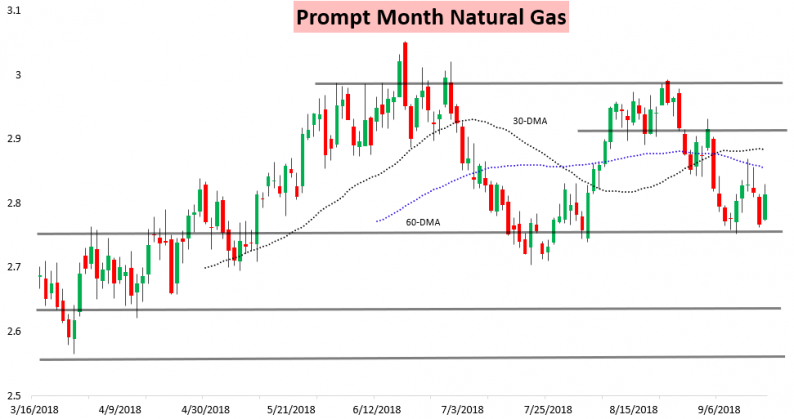

This fit very well with our Morning Update expectations, where we outlined that, “…we are back to pricing in the cash strength that can be expected over the next several days with GWDDs running so far above average and storage still so low. Cash will likely be aided by Florence demand destruction that was not quite as bad as it could have been across the Southeast too…though a morning cash bounce into $2.8-$2.82 is a strong likelihood it should fail…” We got that morning cash bounce right into that $2.8-$2.82 resistance level, and though prices initially moved above it they declined into the settle right back into it. Short-term heat helped cash prices be particularly strong.

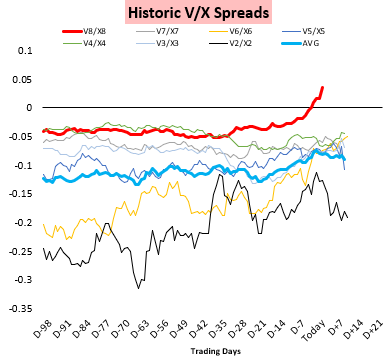

This has pulled the V/X October/November spread far above usual levels for the time of year.

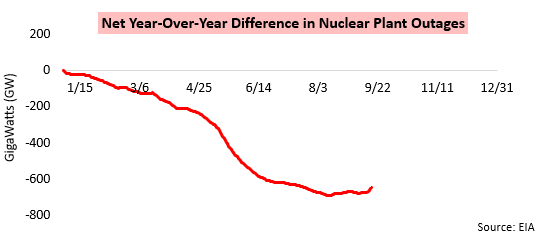

Meanwhile, thanks in part to Florence we saw a spike in nuclear outages the last few days. However, nuclear outages through 2018 have been far below those observed in 2017.

Leave A Comment