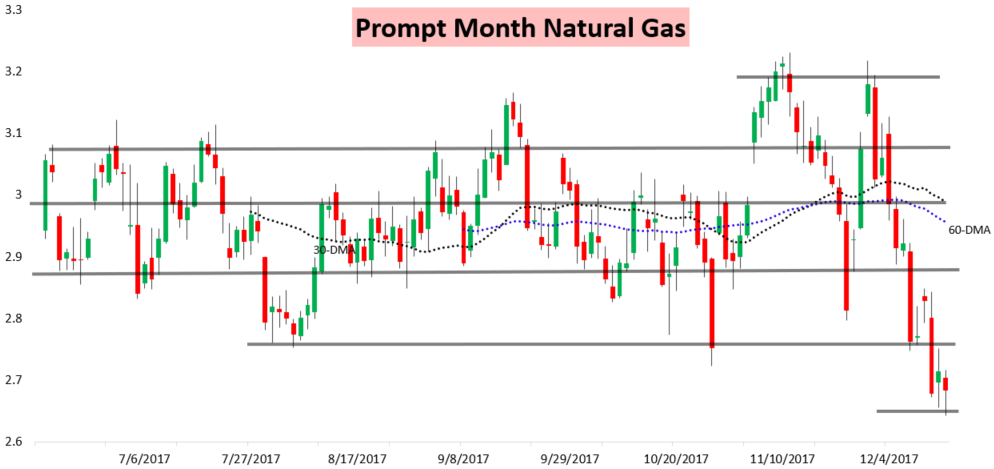

Natural gas prices logged another day of declines today, though they settled a bit above their lows from a couple days ago. Still, they set a new daily low in this recent rout despite bouncing off it on another surge of buying volume.

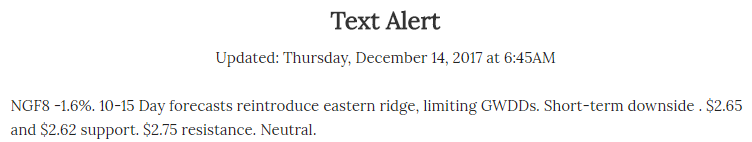

Again today, just like yesterday, the daily price action fell in line with our Morning Text Message Alert sent out to clients before 7 AM, which outlined a bit of short-term downside off warmer overnight model trends but an overall neutral sentiment for the trading day.

Then at 10:30 AM Eastern the Energy Information Administration announced that we had withdrawn 69 bcf of gas from storage in the past week.

This print came in slightly bearish to the 5-year average and far more bearish to year-ago levels, yet was still far less bearish than the small injection that was reported last week.

More importantly, the print missed 5 bcf bullish to our estimate, and in our, EIA Rapid Release sent out within 10 minutes of the report to clients we noted that this was a slightly bullish report which would strengthen $2.65 support. Prices then bounced off that level shortly after our report was sent out.

As mentioned in the report, we see weather increasingly important too. Earlier today it was clear that overnight bearish weather trends were holding the front of the natural gas strip, and the strip settled with the smallest losses later on along it.

Part of this may be that later strips found more support off a tighter EIA print as well, though price action into the weekend may tell more of a story about what is likely to drive price action next week.

Prices also found support off a colder run of the American GFS ensembles this afternoon, which we warned clients was likely in our Morning Update. They decreased the southeastern ridge modestly in the long-range, allowing for a greater expanse of cold across the 8-14 Daytime frame in their afternoon 12z run, as seen below (image courtesy of the Penn State E-Wall).

Leave A Comment