The health care sector is filled with dividend growth stocks. Just a few of the best include Johnson & Johnson (JNJ), Abbott Labs (ABT), and Cardinal Health (CAH).

These stocks are all Dividend Aristocrats – stocks with 25+ consecutive years of dividend increases.

But not all healthcare stocks are thriving…

On February 2, Novo Nordisk (NVO) posted disappointing quarterly results and cut its future outlook. The news sent the stock tumbling 8%, which now trades near a five-year low.

In a way, it was appropriate for the news to come on Groundhog Day. This was the third time in the past six months that the company has cut its earnings outlook.

Novo Nordisk attributes its worsening outlook to heightened political risk in the U.S., its biggest market.

The good news, is that the prolonged downturn has presented investors with an attractive buying opportunity.

Financial Results Overview

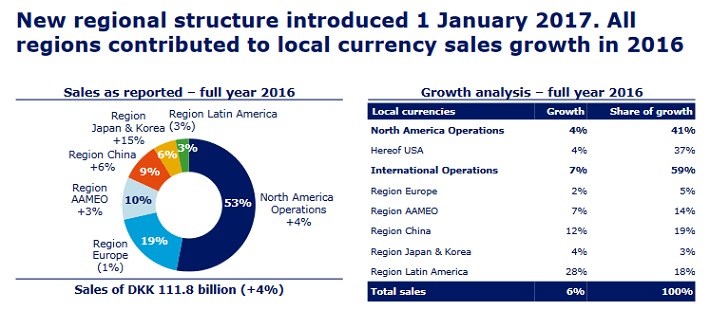

Along with its fourth-quarter and 2016 financial results, Novo Nordisk reduced its forecast for 2017. Novo Nordisk now sees full-year revenue in a range of down 1%, to up 4%. Previously, the company had forecast mid-single digit sales growth this year.

In addition, Novo Nordisk warned operating profit is likely to be between a 2% decline and a 3% increase for the year. Its prior guidance called for low-single digit growth in operating profit.

Management believes the reduced guidance is warranted, because of falling drug prices in the U.S., and the potential for further intervention by the new administration.

In addition, Novo Nordisk is seeing intensifying pressure from generic competition.

Falling drug prices would hit Novo Nordisk hard, since approximately 47% of the company’s annual sales come from outside North America.

Source: 2016 Earnings Presentation, page 5

Aside from heightened regulatory risk, Novo Nordisk is seeing pressure from generic competition. Teva Pharmaceuticals (TEVA) recently announced a generic competitor to Novo Nordisk’s flagship diabetes drug Victoza, one of its biggest sellers.

Leave A Comment