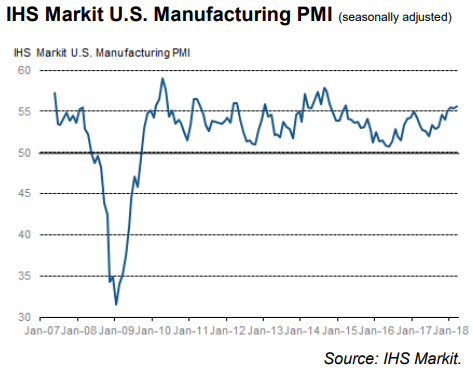

The ISM Manufacturing survey declined and remained in expansion. The key internals likewise declined and remained in expansion. The Markit PMI manufacturing Index, also released today, is in positive territory but improved.

Analyst Opinion of the ISM Manufacturing Survey

Based on these surveys and the district Federal Reserve Surveys, one would expect the Fed’s Industrial Production index to be modestly improved. Overall, surveys do not have a high correlation to the movement of industrial production (manufacturing) since the Great Recession.

From Bloomberg/Econoday:

From the Markit PMI Manufacturing Index:

Operating conditions improve at quickest rate for nine months

- Production and new orders both increase at steeper rates

- Supplier performance deteriorates at quickest pace since February 2014

- Growth in employment picks up to 28-month record

- October survey data signalled a strong improvement in operating conditions across the US manufacturing sector. The health of the sector improved to the greatest extent since January, supported by accelerated expansions in output and new orders. Moreover, export sales increased at the quickest pace since August 2016. Meanwhile, inflationary pressures remained marked despite the rate of input price inflation softening from September. Notably, employment rose at the strongest pace since June 2015.

- The seasonally adjusted IHS Markit final US Manufacturing Purchasing Managers’ Index™ (PMI™) registered 54.6 in October, up from 53.1 in September. The latest index figure indicated a solid improvement in manufacturing operating conditions, that was the fastest seen since the start of the year.

From the Institute of Supply Management report:

Relatively deep penetration of this index below 50 has normally resulted in a recession.

Leave A Comment