Oilfield Equipment industry is vital for drilling activities, thus making the domain heavily dependent on oil prices and the spending levels by producers. Upstream companies are reliant on superior equipment supplies including production machinery, drilling products, pumps, valves, et al to reduce their break-even prices and apply technology advanced fracking methods.

During the slump, the oil explorers slashed their capex and delayed drilling projects, leading to a decline in demand for equipment providers. While the oil prices have certainly rebounded from hitting the multi-year lows, the situation has not translated into a rosier scenario for equipment suppliers due to various factors.

Notably, North America is the leading market for oilfield equipment, accounting for above 40% of the global market. However, infrastructural bottlenecks especially in North America’s hottest shale play, Permian Basin, is forcing producers to lower their spending capacities as well as output levels of late. Even Canada is suffering the scarcity of takeaway capability, inducing receding drilling activities. The pipeline pinch is certainly hurting equipment providers, who can’t cash in on the crude recovery. Cost inflation along with labor and equipment shortages are further worsening matters for equipment providers.

Industry Lags in Terms of Shareholders Returns

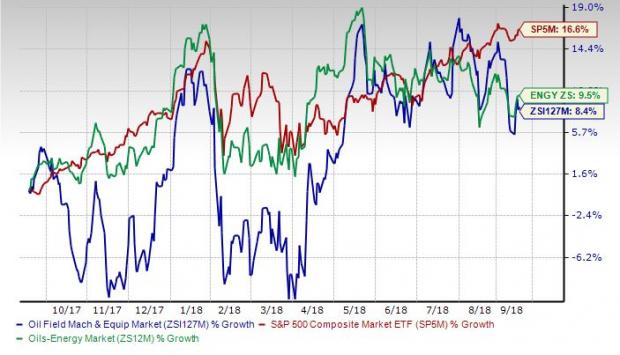

Looking at shareholder value over the past year, it is quite evident that the crude price recovery has not been able to provide a much-needed impetus to mechanical and equipment industry as the industry is lagging both the broader sector and the S&P 500 market.

Capital discipline by upstream players, dearth of labor and pipeline crisis have weighed on the industry in recent times, reflecting disappointing results for the firms.

One Year Price Performance

Evidently, the Zacks Oil and Gas- Mechanical and Equipment Industry, a 15-stock group within the broader Zacks Oil and Energy Sector, has underperformed both the S&P 500 index and its own sector over the past year. While the stocks in this industry have collectively gained 8.4%, the Zacks S&P 500 Composite and the Zacks Oil and Energy Sector have rallied 16.6% and 9.5%, respectively.

Leave A Comment