Crude Oil futures for June delivery settled yesterday at $48.43 a barrel, with current price action seeing a follow through of the declines from yesterday. The weekly crude oil inventory report showed a surprise 1.3 million barrel buildup in commercial Crude oil stockpiles for the week ending May 13th, less than analyst expectations of a 3.1 million drawdown. In the previous week, crude oil inventories fell 3.4 million barrels. The Energy and Information Administration’s (EIA) report contrasted yet again with the American Petroleum Institute’s (API) weekly inventory report released on Tuesday, which showed a 1.2 million drawdown.

The EIA report showed that gasoline production fell averaging 10 million barrels per day while distillate fuel production increased on average about 4.8 million barrels per day. The EIA said, “U.S. crude oil inventories are at historically high levels for this time of year.” Oil prices had briefly dipped after the release but edged higher against a stronger US dollar which rose steadily ahead of the FOMC meeting minutes.

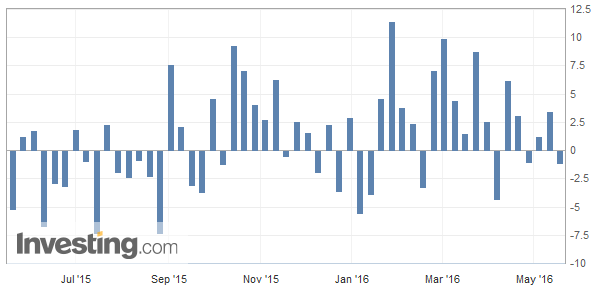

Weekly Inventory Report – API (-1.140Mn) For May 13, 2016

Weekly Inventory Report – EIA (1.31Mn) For May 13, 2016

This week, Goldman Sachs joined the Oil bull-wagon forecasting WTI’s price at $45 a barrel for Q2 2016 while it expects WTI to average at $50 a barrel in the second half of the year. GS notes that the higher prices will likely bring low-cost producers back into the market. This is expected to see a gradual decline in oil inventories throughout the second half of 2016 with expectations that oil could return to surplus during the first quarter of 2017.

Crude Oil Technical Outlook

Leave A Comment