It is impossible to tell the whole oil story, but perhaps I can offer a few insights regarding where we are today.

[1] We already seem to be back to the falling oil prices and refilling storage tanks scenario.

US crude oil stocks hit their low point on January 19, 2018, and have started to rise again. The amount of crude oil fill has averaged about 365,000 barrels per day since then. At the same time, prices of both Brent and WTI oil have fallen from their high points.

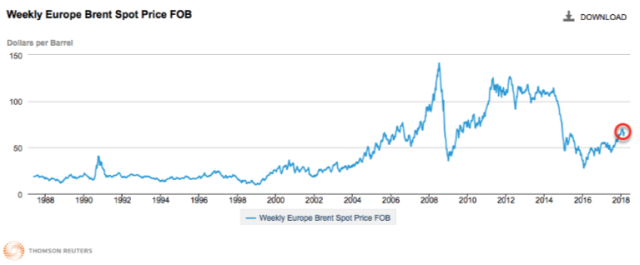

Figure 1. Average weekly spot Brent oil prices from EIA website, with circle pointing to recent downtick in prices.

Many people believe that the oil problem when it hits, will be running out of oil. People with such a belief interpret a glut of oil to mean that we are still very far from any limit.

[2] An alternative story to running out of oil is that the economy is a self-organized system, operating under the laws of physics. With this story, too little demand for oil is as likely an outcome as a shortage of oil.

Oil and energy products are used to create everything, even jobs. If all humans have is energy from the sun, plus the energy that all animals have, then humans would be much more like chimpanzees. All humans would be able to do is gather plant food and catch a few easy-to-catch animals (earthworms and crickets, for example). They certainly could not extract oil or find uses for it.

It takes a self-organized economy to support the extraction and sale of energy products. We need a complex web that includes:

The things that go wrong can with this economy can be on the buyers’ end of the economy. Buyers can have jobs, but they may not pay well enough to afford the output of the economy. A falling share of the population may be able to afford cars, for example.

[3] It is possible that a recent rapid increase in oil supply is contributing to the current mismatch between supply and demand.

Data of the US Energy Information Administration indicates that US oil supply has recently begun to surge. It is not just crude oil production that is higher. Natural gas liquid production is higher as well. As a result, Total Liquids production is reported to be more than 16 million barrels per day in November 2017.

Figure 2. US Liquids Production, based on International Energy Data provided by the US EIA.

Oil production of the rest of the world has been relatively flat, as planned.

Figure 3. World excluding the US oil production by type, based on EIA International Energy data through November 2017.

Total world production, combining the amounts on Figures 2 and 3, set a new record of 99.1 million barrels of oil per day for November 2017, based on EIA data. This level is above the November 2016 level, which was the previous record at 98.9 million barrels per day.

At this high level of production, it is not surprising that the economy cannot absorb the full amount of extra supply.

There are also a number of issues that affect buyers’ demand for oil.

[4] The percentage of US residents who can afford to buy a new automobile or light truck seems to be falling over time.

If we look at the number of autos and truck sold in the US, per 1000 population, we see a pattern of falling humps, as a smaller and smaller share of the population can afford a new car or light truck, each year.

Leave A Comment