On the Investor Insights blog we have been providing a great deal of coverage on the divergences between the “haves” and “have nots”. The performance chasing in high flying stocks like Amazon, Netflix, Google, and Facebook has created a wide gap between the “average” stock in the S&P 500 Index.

Here is an interesting statistic from Bespoke Investment Group to back up this claim:

In the S&P 500 as a whole, the average stock is currently 19.4% below its 52-week high. Four sectors have readings below this level — Telecom (-22%), Consumer Discretionary (-22.2%), Materials (-24.5%) and Energy (-42.5%).

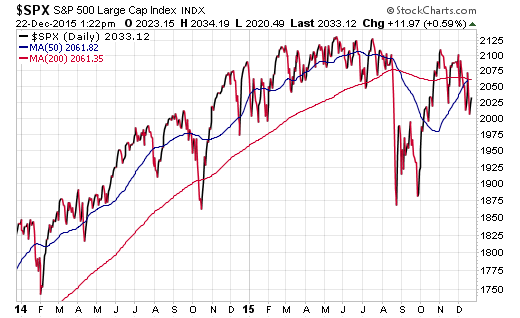

Essentially this is telling us that the average stock is very near bear market territory. Pretty crazy when you think about the fact that the S&P 500 Index is only about 5% off its all-time high.

The reason for this very differentiated performance is the market capitalization weighting of the index. A narrow group of large stocks in this basket are propping up the smaller underperformers to create the illusion of strength in the market as a whole.

This is also why there is such a great deal of pessimism on Wall Street. Those that own individual stocks are feeling the pain of those double digit losses unless they were lucky enough to pick one or two winners. However, in a group of 25 or 50 holdings, the odds seem to favor a greater number of losers.

There is two ways to look at this data:

My prediction in 2016 is that there will be a great deal of reshuffling in the sector deck. I don’t know when or where it will occur. I’m not going to predict that energy or basic materials will be the big leader next year or that the consumer stocks will falter. I’m simply pointing out that there will likely be some reversion to the mean along the way. This will create new risks and opportunities depending on how your portfolio is currently positioned.

Leave A Comment