Back in October, I noted “Wall Street’s mistake” — solar panel makers, and their undervalued stocks.

Since then, the Guggenheim Solar ETF (NYSE: TAN) that I recommended is up more than 10%. First Solar Inc. (Nasdaq: FSLR), mentioned in the same piece, is up more than 40%.

And it’s just the beginning of a move higher in this sector.

What’s driving it?

Solar Panel Makers

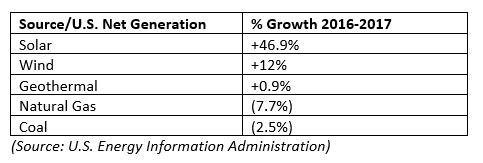

The amount of solar power produced by America’s utilities and independent power companies hit a record in 2017, rising by nearly 47% last year, according to the Department of Energy’s record keepers.

Add in “small-scale” solar — the thousands of homes and businesses with their own panels — and you’re talking about nearly 2% of U.S. power generation coming from solar.

Two percent may not sound like much. But, for comparison in 2015, solar made up less than half of 1%. In 2012, it was .001% — that’s one-tenth of 1%.

That makes solar the fastest-growing source of electricity on the U.S. power grid:

What’s driving the trend? The cost of high-efficiency solar panels fell nearly 40% last year, thanks to changes in panel-manufacturing technology, and gains in global production.

But there’s even more profitable news to this picture…

The Year of Solar Power

Here’s the kicker: Both the IRS and federal energy regulators recently handed out little-noticed (but hugely important) rulings.

I think those rulings are guaranteed to encourage even more solar power generation.

It has to do with energy storage; i.e., really, really powerful batteries.

Leave A Comment