It might sound somewhat defeatist, but in a year like 2015, I’m just happy that my entry in the Best Stocks contest is almost in the black. It’s not that I don’t expect Prospect Capital (PSEC) to deliver solid returns. In fact, I expect it to deliver returns of 50% or more over the next 12 months. It’s just that 2015 has been one of those years when cheap value stocks have a way of getting cheaper.

With a little over one quarter to go, let’s revisit Prospect Capital and why I still believe that winning the contest this year is a very real possibility.

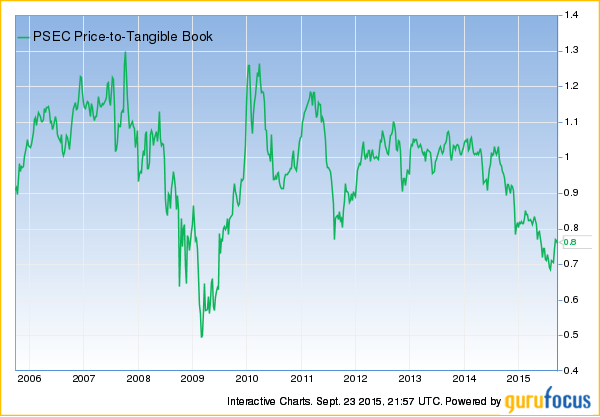

I’ll start with valuation. With the single exception of the 2008 meltdown, Prospect Capital is the cheapest it’s ever been based on the price/book ratio.

Prospect trades for just 77% of book value. Under normal conditions, you would expect Prospect to trade at a slight premium to book value. After all, management expertise and access to cheap capital are worth something. At current prices, the market is implicitly saying that book value is either overstated by 23% or that it expects management to destroy a lot of value in the months to come.

Now, I routinely criticize the price/book ratio as a value metric for most common stocks. Given the distorting effects of depreciation and general price inflation, book value is a meaningless metric for most mainstream common stocks. But in the case of business development companies like Prospect Capital, the book value is assessed every quarter by professional valuation experts.

Could their estimates be overstated? Sure. There is always room for interpretation, and Prospect has routinely been criticized for being a little too aggressive on their portfolio valuations relative to their peers. Let’s assume the worst and say that the portfolio is overstated by a couple percentage points. Given that the stock trades for just 77 cents on the dollar, I’d say we have a nice margin of safety.

Leave A Comment