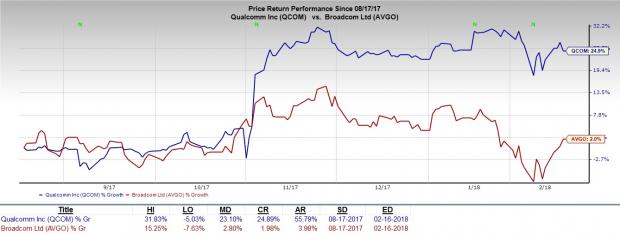

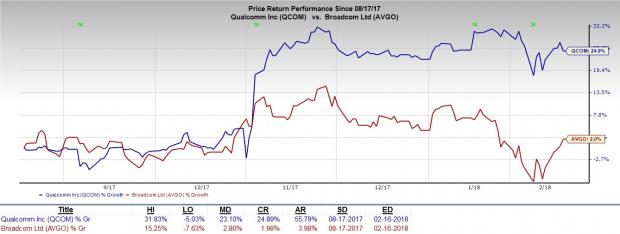

Qualcomm’s (QCOM – Free Report) CEO Steve Mollenkopf, CFO George Davis and Chairman Paul Jacobs and other office bearers met Broadcom (AVGO – Free Report) representatives in a two-hour meeting. Neither party said anything about what transpired at the meeting but Broadcom representatives reportedly came away with the feeling that they were listened to without comment. Qualcomm representatives said that the board would meet to discuss the next steps.

The Broadcom Offer

Broadcom’s attempt to acquire Qualcomm to create a wireless powerhouse was thwarted yet again when its revised bid was rejected unanimously by Qualcomm’s board of directors.

In November, Broadcom offered $70 a share, of which $60 was to be paid in cash and the rest in shares. The revised offer, which is Broadcom’s “best and final offer”, values each share at $82 ($60 a share in cash and the rest in shares).

Considering the fact that the deal reduces competition, there’s a good chance that regulators in several countries will oppose it. If the deal is cancelled on account of regulatory opposition, Broadcom will pay $8 billion for the disruption caused.

Broadcom expects to obtain necessary approvals to close the deal within a year. If it takes longer, it will pay 6% a year of the amount to be paid in cash as compensation.

Since this is an unsolicited, hostile bid to take over control of the company, Broadcom is also looking to replace the entire Qualcomm board with 11 people of its own choosing. Shareholders will cast their votes on Mar 6.

Is Qualcomm’s Concern Justified?

Qualcomm Chairman Paul Jacobs stated in the open letter to Broadcom CEO Hock Tan, “Your proposal ascribes no value to our accretive NXP acquisition, no value for the expected resolution of our current licensing disputes and no value for the significant opportunity in 5G,” and “Your proposal is inferior relative to our prospects as an independent company and is significantly below both trading and transaction multiples in our sector.” Moreover, the bid contains “serious deficiencies in value and certainty.”

Leave A Comment