Many market participants see themselves as value investors, striving to buy at a discount and sell at a premium to value.

Most understand the concept of margin of safety (MoS), first applied to investment affairs by Benjamin Graham. They see it as a one dimensional concept: the difference between value and price. The larger that margin, the safer the investment opportunity. And also the more compelling, for a given potential reward.

Some understand the three sources of genuine value: i) asset value, ii) earnings power value (EPV), and iii) earnings growth at returns above cost of capital.

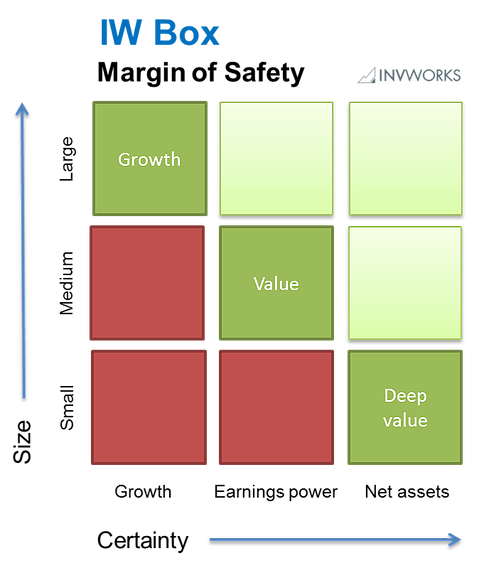

But only a few bring the reasoning to the logical conclusion that there are two dimensions to the margin of safety: size and certainty.

Today, we are sharing with you the IW Margin of Safety Box (IW Box for short), a diagrammatic framework that has helped us enormously over the years in our investment and capital allocation decisions.

The IW Box puts together the two dimensions of the margin of safety: size and certainty. The further to the top (larger MoS) and right (more certain MoS), the safer the investment opportunity. And for a given potential reward, the more compelling. Cells at and above the diagonal represent adequate margins of safety. Cells below the diagonal, insufficient margins to open new long positions.

Evolution of value investing

In his investment decisions, Benjamin Graham confined the source of value to the net value of tangible assets, ideally current assets net of all liabilities (net net working capital). He viewed the value of intangibles, earnings power and growth as too uncertain to meaningfully contribute to value, and by extension, margin of safety.

Within the IW Box framework, he limited his investments to the rightmost column, in which the MoS, entirely substantiated by net assets, can be estimated with high certainty. The more tangible and current the assets, the more to the right within that column. And the larger the price discount relative to net asset value, the higher up along the column.

Even today, some investors refuse to pay for anything beyond some conservative estimation of liquidation value. But while it was once possible to find opportunities in the top-right cells (medium and large, certain MoS), today’s asset-focused value investors find their cigar butts in the bottom-right cell (small, certain MoS).

Most contemporary value investors, including Warren Buffett and Charlie Munger, operate with a wider conception of value. They view intangible assets and the associated EPV as legit contributors to value, and by extension to margin of safety (MoS). They search for value in the middle column of the IW Box. The early Warren Buffett found numerous bargains in the top cell of the central column (large, relatively-certain MoS). Today, he and most other value investors have to settle for opportunities in the central cell (medium, relatively-certain MoS).

Leave A Comment