S&P 500

The S&P 500 initially fell on Monday but it appears that the 2425 level is trying to offer a significant amount of support. By forming a hammer for the day, this completely contradicts the shooting star from Friday. If we can break above the top of the shooting star from the Friday session, that should be a nice buying opportunity. Ultimately, I believe that the market will reach towards the 2475 level, as certainly the market has been bullish. I believe that the uptrend is still in effect until we break down below the 2400 level. Ultimately, I believe that the markets will be choppy, mainly because there are a lot of worried participants right now due to the high pricing. However, I would be the first person to point out that earnings season was stronger than anticipated on many fronts, so I think we should continue to find plenty of people willing to put money to work.

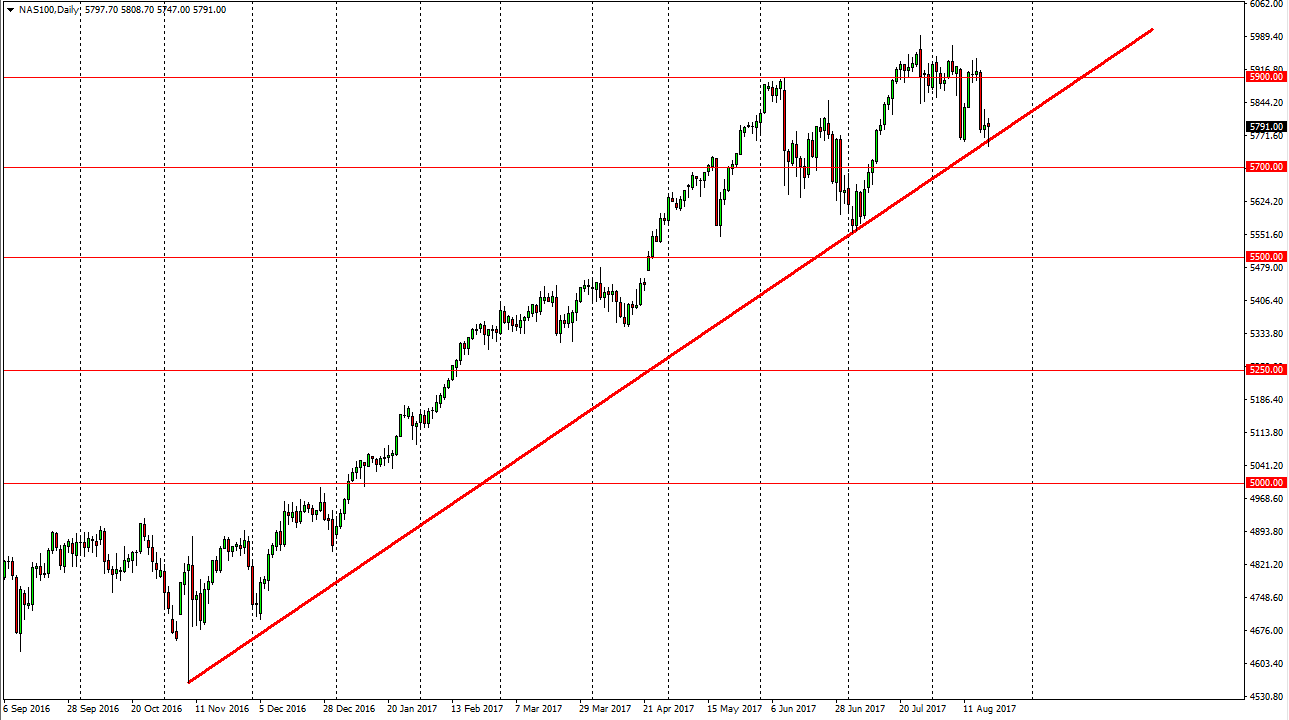

Nasdaq 100

The Nasdaq 100 also ended up forming a hammer, but on this chart, you can see clearly that there is an uptrend line that has held. If we can break above the top of the shooting star from the Friday session, I think we go back towards the 5900 level, and perhaps reaching at that point towards the 6000 level. This essentially sets up the market breaking above the 5800 level as a buy signal. I think that there is plenty of support at the uptrend line, which is essentially the bottom of the daily candle. I also recognize that 5700 would be supportive as well. Once we break down below that level, then we probably have further to fall, perhaps as low as 5500 in the short term. All things being equal, the Nasdaq 100 has lead the way.

Leave A Comment