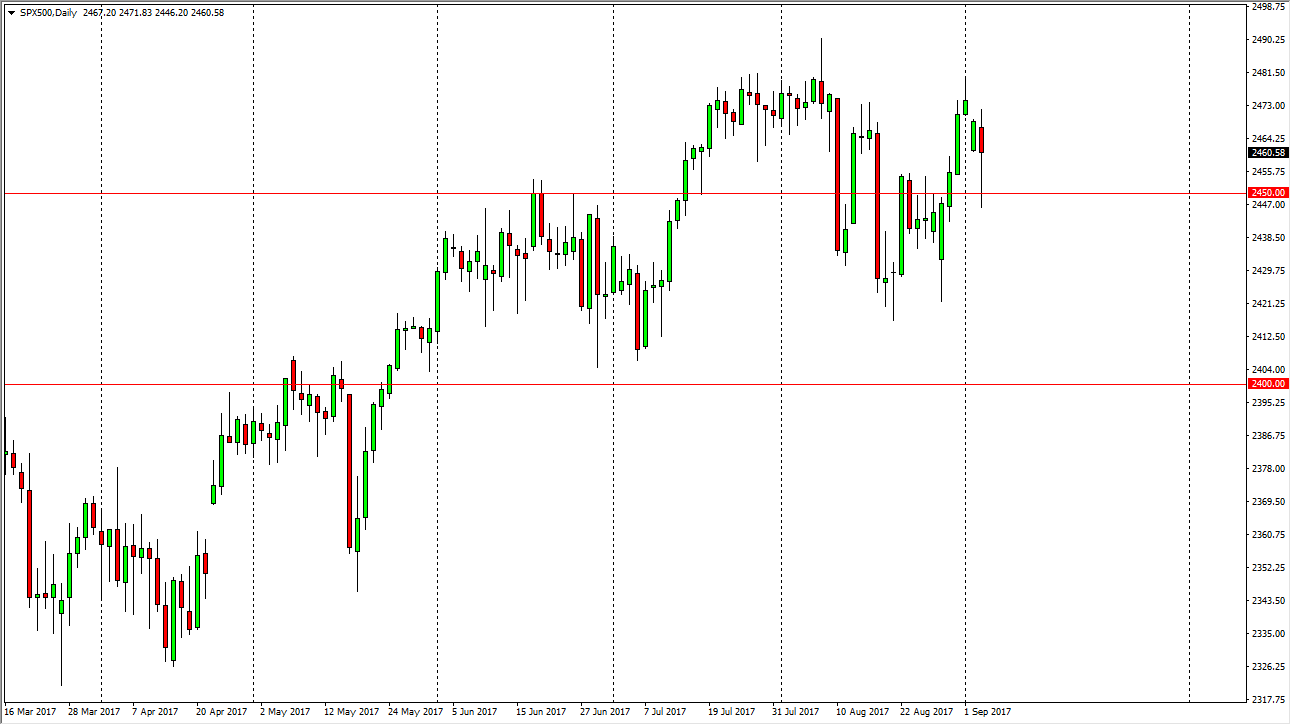

S&P 500

The S&P 500 sold-off rather drastically during the session on Tuesday, as US traders came back to work. However, you can see that we found support at the 2450 level and ended up forming a hammer for the day. This shows just how resilient the market is, and with this being the case it’s likely that the algorithms will step back into the market and by each dip. While I think that the market may need to pull back in order to get a nice correction, we may not get that in the short term. Currently, the only thing you can do is buy, as I certainly wouldn’t be shorting this market. This correction that is coming could be soon, but right now I don’t see anything on the charts that suggests it’s coming today.

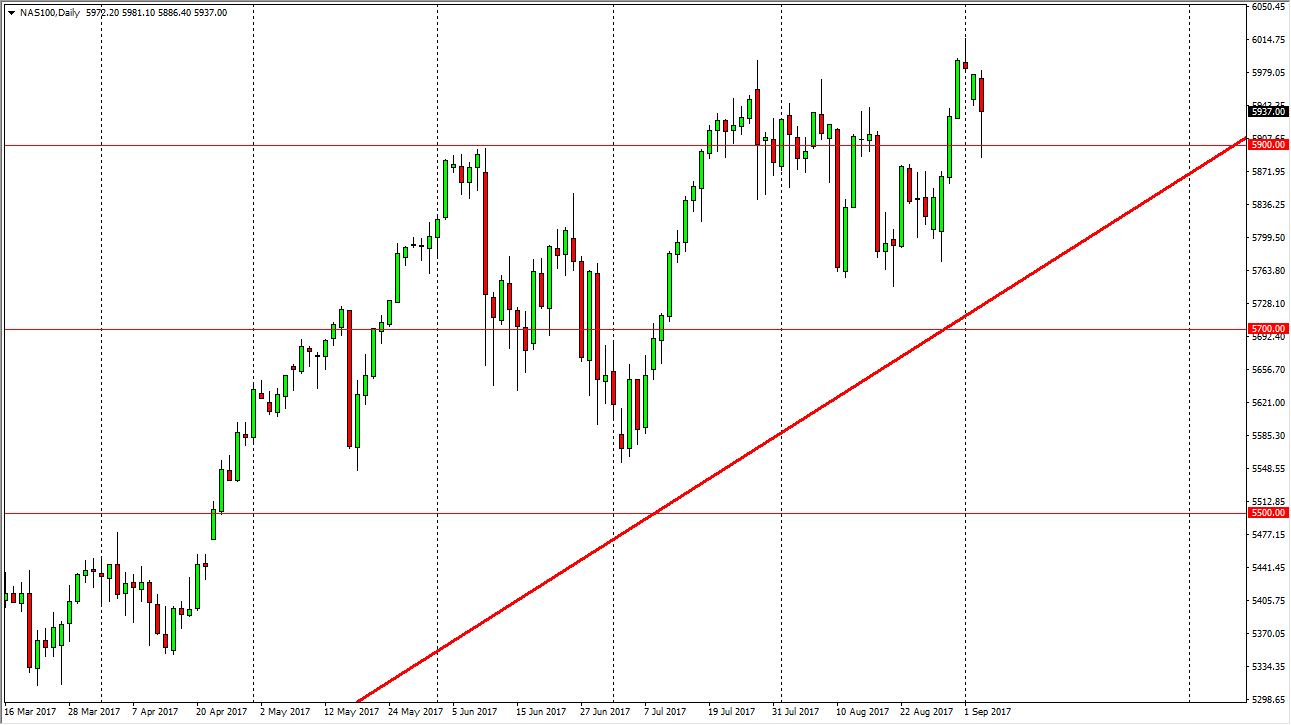

Nasdaq 100

The Nasdaq 100 also fell but found support near the 5900 level. By bouncing from there and forming a bit of a hammer, that’s a very good sign, and it suggests that the algorithm-based traders are still buying at the loss of roughly 1%. This seems to be a phenomenon that we have seen all summer, and it now looks as if we will go looking for the 6000 level above. I have a trend line on the charts, and it has not been broken. Because of this, I believe that dips continue to offer buying opportunities in what has been a stubbornly bullish market. A daily close above the 6000 level would be a nice signal to start going long on a longer-term move, but until then I think that short-term buying the dips types of moves will probably what we see on the whole. Ultimately, this market tends to lead the rest the US indices.

Leave A Comment