The S&P 500 made a monthly closing all-time high in August. This is uncommon, because the U.S. stock market is usually more volatile from May – September.

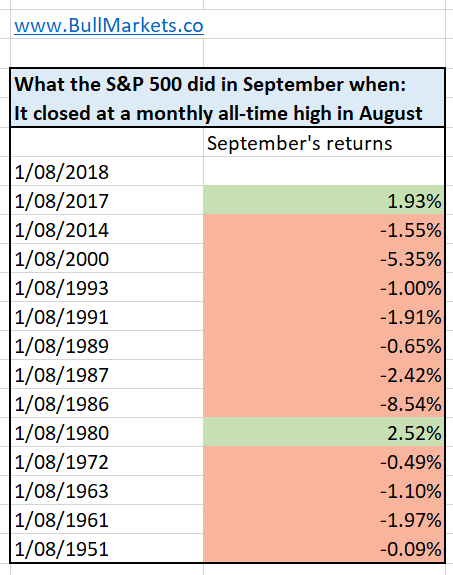

Historically, this has been a short term bearish sign for the U.S. stock market in September. Here’s what the S&P did in September when it closed at a monthly all-time high in August.

As you can see, the S&P tends to make a short term pullback in September. However, this short term weakness usually doesn’t extend beyond September. Forward returns after September are no different than random.

Conclusion

This study is a short term bearish factor for the U.S. stock market in September. If you are not long stocks right now and are thinking about chasing the rally, you might want to wait a little before joining the long side.

Leave A Comment