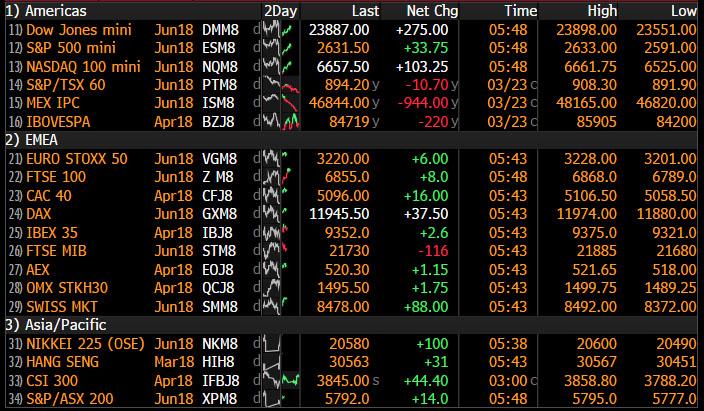

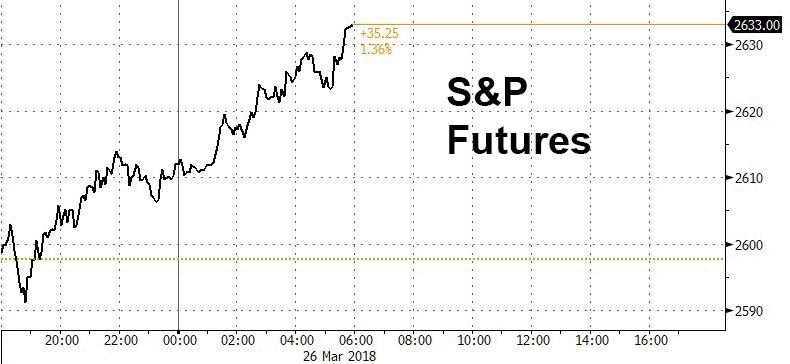

It seems that “Black Monday” has been averted, with global risk sentiment making a full reversal to start the week, and the precipitous selloff from Thursday and (Black) Friday turning into a furious rally on Monday, starting in Asian markets and proceeding to Europe and US stock futures, which are up 1.4%, and back over the key 2,610 support level.

In other words, once again the 200DMA at 2,585 has proven a key support for the S&P500.

“It was the week when one bad thing led to another, it was a perfect storm,” said Jim Paulsen, chief investment strategist at Leuthold Weeden Capital Management. “You took the starch out of the FANGs, you saw banks, industrials, discretionary companies reacting to the negative news. What investors are not pricing in is a potential impact on companies’ profit margins.”

On Monday, the perfect storm had faded, although it remained to be seen if this was just the eye of the hurricane.

What prompted the surge: the most commonly cited reason is that jitters over brewing trade tensions between the U.S. and China have again eased, after Treasury Secretary Steven Mnuchin told Fox News that he’s “cautiously hopeful” the U.S. can reach a trade deal with China that will avert the need for Trump to impose up to $60BN in tariffs on China – of course, what else would he say?

There was also renewed optimism that the United States and China are set to begin negotiations on trade, following reports in both the FT and WSJ, further easing fears about a trade war between the world’s two largest economies. MSCI’s world equity index turned positive on the day, having earlier hit its lowest level since February 9, after a Wall Street Journal report that Treasury Secretary Mnuchin was considering a visit to Beijing to begin negotiations.

“I don’t think that long-term the tariffs will continue to be enforced,” Scot Lance, managing director at California-based Titus Wealth Management, said by phone. “They’ll pull them off the table at some point, I just don’t know if that will be a week, a month, a quarter? Could it last a whole year? I don’t necessarily think it’ll last for a long time.”

All of the uncertainty has kept the once-reliable dip buyers on the sidelines this time. Consider: as Bloomberg notes, the S&P 500 has closed lower than the midpoint of its daily range for 10 straight days, the longest stretch since at least 1982. That suggests traders are finding reasons to dump shares in the afternoon rather than buy dips.

That sentiment may have reversed this morning, however: “It appears that the market is not expecting a full-blown trade war, and a currency war for competitive advantage is not a likely option at this moment,” said Mizuho’s Ken Cheung, who will clearly retract and say the opposite should futures reverse their gain and slump. “Risk sentiment, as being reflected by Asian equities, and further responses from the Chinese authorities to the trade war will drive the market.”

Also overnight, as we reported previously, the U.S. and South Korea reached an agreement on revising their trade deal, with South Korea avoiding steel tariff, which was also to be expected, as the target of Trump’s trade war – it has become especially obvious by now – is not Europe, and not all of Asia, but simply China. As a result, S&P futures are sharply higher in early trade, and the S&P trying to undo all of its 2.1% losses from Friday, although it may have a harder time to offset last week’s 6% loss, which was the biggest weekly drop since early 2016.

European shares headed for their first gain in four days as investors assess the latest developments in a trade conflict between the world’s two largest economies. European bourses are higher across the board (Eurostoxx +0.4%) with the exception of the FTSE MIB (-0.3%), shrugging off Friday’s negative sentiment. Sectors are making broad gains, healthcare is outperforming after a positive drug update from Roche (+1.6%) and energy is underpinned despite slightly softer oil prices.

Asian markets also stabilized, with the ASX 200 down -0.5% led lower by its largest-weighted financials sector after the harsher losses seen in its US counterparts, while the Nikkei 225 fell to a near 6-month low, before staging a late rally back into positive territory, closing 0.6% higher after dropping -1.3%. Elsewhere, Shanghai the Shanghai Composite dropped -0.6%, weighed by trade tensions and rising Chinese money market rates (HKD 12-month HIBOR at 9-year high), while the KOSPI (+0.8%) bucked the trend after news that US and South Korea agreed in principal to a revised FTA and with South Korea to be exempted from US tariffs.

In macro and FX, the risk on sentiment sent the yen sliding from a 16-month high as calm returned, if only for the time being, to world markets amid signs U.S.-China trade frictions may be easing. The USD/JPY rose 0.3% to 105.10 after earlier falling to 104.56, lowest since November 2016.

“Risk aversion seems to have come a full circle with the first reaction to U.S.-China trade tensions last week, and it may be difficult to buy up the yen further without additional negative factors,” said Koji Fukaya, CEO at FPG Securities.

On the other side, Daisuke Karakama, chief market economist at Mizuho Bank in Tokyo said that “markets are now in the phase of waiting for Nikkei stock average to fall below 20,000 and USD/JPY to drop towards 100, so it’s meaningless to give specific projections before those levels.”

Leave A Comment