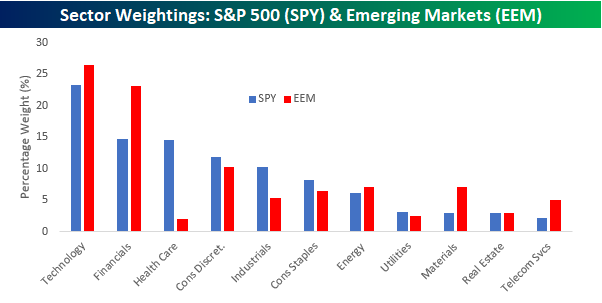

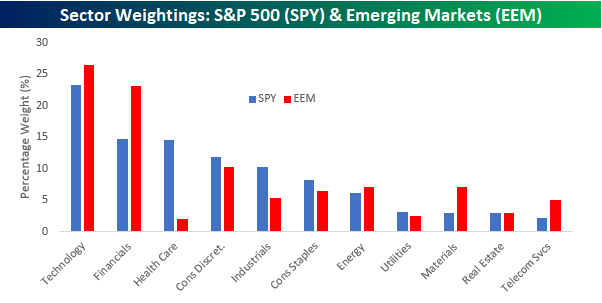

If we had a bitcoin for every time we heard someone say that the S&P 500 has been too reliant on the performance of tech stocks for its gains this year, we would be very rich. But if you think the S&P 500 is dangerously overweighted towards the Technology sector, beware of emerging markets. While the Technology sector’s 23% weighting in the S&P 500 makes it by far the largest sector in the index, the ETF tracking Emerging Markets (EEM) is even more heavily weighted towards technology. The chart below compares sector weightings in the ETFs that track the S&P 500 and Emerging Markets (EEM). As you can see, Technology has a 26.5% weighting in EEM. So if you think the S&P 500 is too top heavy with tech, EEM is even more exposed.

In addition to the large weighting in tech, EEM also has a lot of exposure to Financials. That sector’s weighting is nearly 60% larger in EEM (23.1%) than it is in SPY (14.6%). With such large weightings in both sectors, just under half of EEM’s weighting is in Technology and Financials. So where is EEM underweighted relative to SPY? That would be in the Health Care sector. As shown below, Health Care accounts for 14.5% of SPY, but the sector’s weighting in EEM is a puny 1.95%.

Leave A Comment