Tech stocks lost nearly $1 billion on Friday. Prices plunged following a bearish Goldman Sachs report suggesting a collapse is imminent. Analyst Robert Boroujerdi pointed to similarities between the market’s five biggest tech stocks- Apple, Microsoft, Alphabet, Amazon and Facebook- and the 1999/2000 tech bubble.

“The recent run in large-cap tech stocks has evoked memories (nightmares?) for some investors of the last euphoric NASDAQ run,” said Boroujerdi. He says these stocks are not as profitable as stocks back in 2000, and have an oversized impact on the whole market.

However, stocks are already back in recovery as excited investors bought on the dip. We wanted to get the lowdown on these five critical stocks from the Street’s best analysts- and find out what prices they are predicting for the next 12 months.

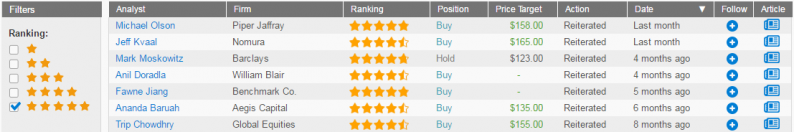

To track recommendations from only top analysts we turned to TipRanks stock analysis page and filtered the ratings to five-star analysts. This finds the analysts that have the highest success rate and average return while cutting out the advice of underperforming analysts.

In terms of general market sentiment, TipRanks users can also limit the consensus rating and average price target to ratings from only the top analysts. Simply select the ‘best preforming analysts’ button at the top of the stock page and let the TipRanks formula do the rest!

Now let’s delve into the outlook for these five stocks:

Apple (AAPL)

The stock has a strong buy analyst consensus rating, with a $167 price target (indicating 15% upside potential from the current share price). Shares are still at $145 vs $155 pre-fall.

Five-star Drexel Hamilton analyst Brian White has not been deterred by Apple’s 7% drop. White explains, “In our view, Friday’s sell-off in Apple represents yet another buying opportunity as investors turn their focus to the iPhone 8 this fall, along with the company’s raised capital distribution initiative, depressed valuation and new innovations. We continue to believe Apple remains among the most underappreciated stocks in the world.”

Leave A Comment