In this article, we’re going to look at the three main causes of the stock market correction that occurred in March which came close to matching the lows set in February. When you understand the reasons the market fell, it helps you figure out where stocks will likely go for the rest of the year. Obviously, new headlines always pop up, but it’s good to understand the basics of why markets moved in the past before making future projections. The three main stories which tell us why stocks fell in March are a weakening economy, which should be temporary, a more hawkish Fed, and the rumors of a trade war with China. We’ll delve into those reasons in this article.

Weak GDP Growth Is Probable In Q1 Despite Fiscal Easiness

The Fed recently increased its target for GDP growth in 2018 from 2.5% to 2.7%. Many other forecasts are above 2.5%. For example, Bank of America expects 2.9% growth. The optimism stems mainly from the tax cuts, the momentum shown in the 2nd half of 2017, and the recent $1.3 trillion spending bill which increases military spending by $80 billion, which is the biggest increase in 15 years, and adds $10 billion in infrastructure spending. This spending on programs isn’t that large, but the fact that the government is projected to run increasing deficits at a time when the labor market is nearing full employment shows how easy fiscal policy has become.

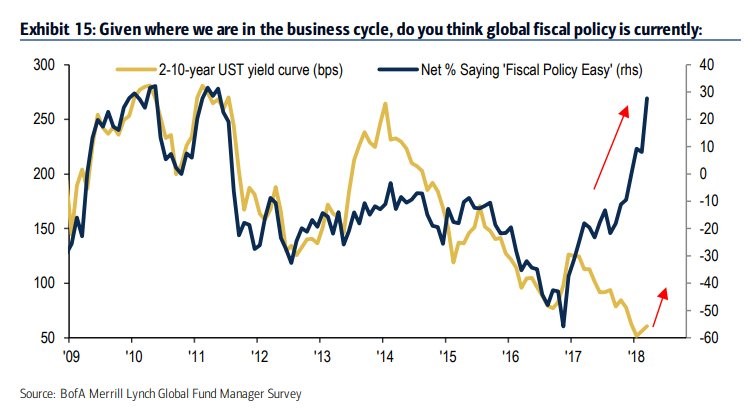

The chart below shows the net percentage of fund managers who claim fiscal policy is easy is the highest since 2010 and 2011.

Unusually Easy Fiscal Policy Near The End Of The Expansion

Even with the improvement to fiscal policy, the Atlanta Fed GDP Now expects 1.8% growth in Q1 and the blue chip index is at 2%. Weak retail sales, auto sales, and housing have combined to push down the estimates for Q1 GDP. The manufacturing sector has been solid as the latest durable goods report from February showed an 8.9% year over year growth rate in new orders and an 8% growth rate in core capital goods. Manufacturing is a small part of the economy, so it’s not enough to boost the overall result. Durable goods orders only contributed 7.6% to GDP in 2017.

Leave A Comment