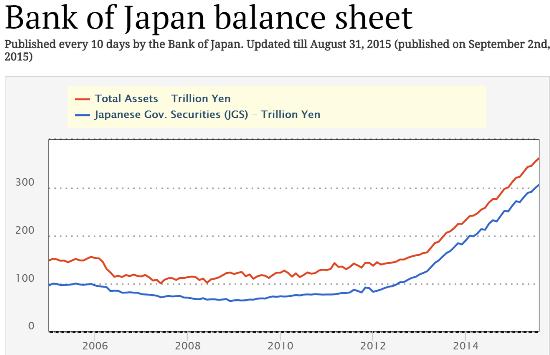

It was just three years ago that new Prime Minister Shinzo Abe promised to pull Japan out of its “lost decades” by printing epic amounts of new yen. He got what he wanted from the Bank of Japan, which bought up pretty much all the available government debt with newly-created currency. After hardly changing at all in the previous seven years, the BoJ’s balance sheet — a proxy for its money creation — tripled.

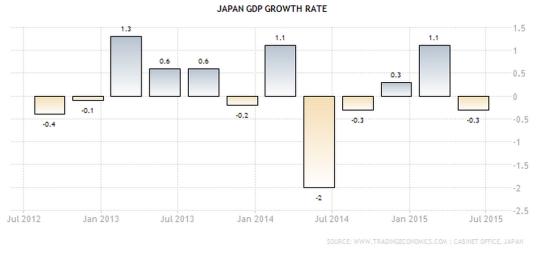

That’s a lot of yen, and you’d think that, other things being equal, such a cash tsunami would get some animal spirits going. It did pump up the Nikkei stock index, which more than doubled between 2012 and July 2015. But that’s about all Abe has to show for his bold plan. GDP growth is now negative in the aggregate over the past five quarters.

And the list of other bad numbers is comprehensive:

• Government debt hit yet another record in July, at ¥1.057 quadrillion.

• The Nikkei is down by 10% since August.

• Inflation has fallen perilously close to zero.

• And China, the engine of Asian (and globlal) growth, just reported August trade numbers that are apocalyptic: Imports down 14.3% y-o-y, exports down 6.1%, overall trade down 9.7%.

Part of the problem is that beyond a certain point, debt is debilitating and (as the world is finding out) money printing on the current scale can’t overcome today’s liabilities. The other, perhaps much more serious problem is demographics. Japan’s population is the oldest in the world and the culture isn’t open to the tens of millions of young immigrants it would take to reverse the trend. As the Daily Times amusingly put it in August:

Leave A Comment