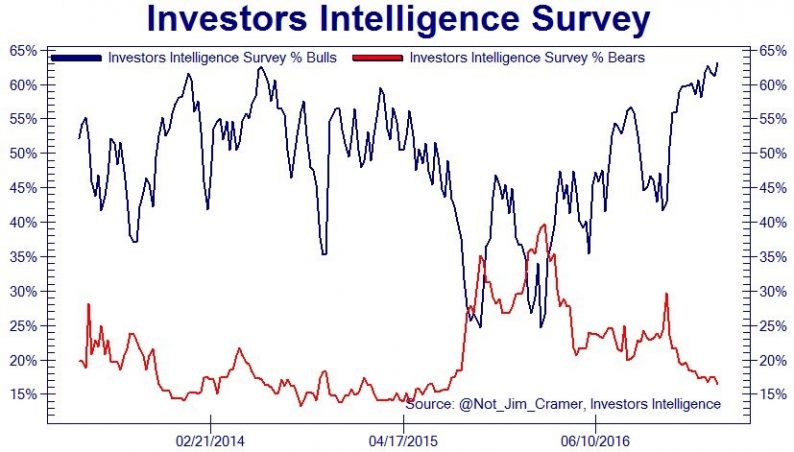

There is a distinct possibility we are closer to the end of this bubble stock market than most expect. It’s difficult to determine where stocks are going when they are priced based on the fundamentals. When they are increasing based on sentiment alone, it becomes nearly impossible. Since sentiment is very important to this market, I put the latest Investor’s Intelligence Survey below. 63.1% of the investors surveyed were bullish, which is the highest rating since 1987. I don’t understand why the retail investors I talk to are willing to invest at such expensive valuations. Calling the latest speculators retail investors is too much of a compliment. The only thing to call the electrician I know buying stock in DryShips is a reckless speculator.

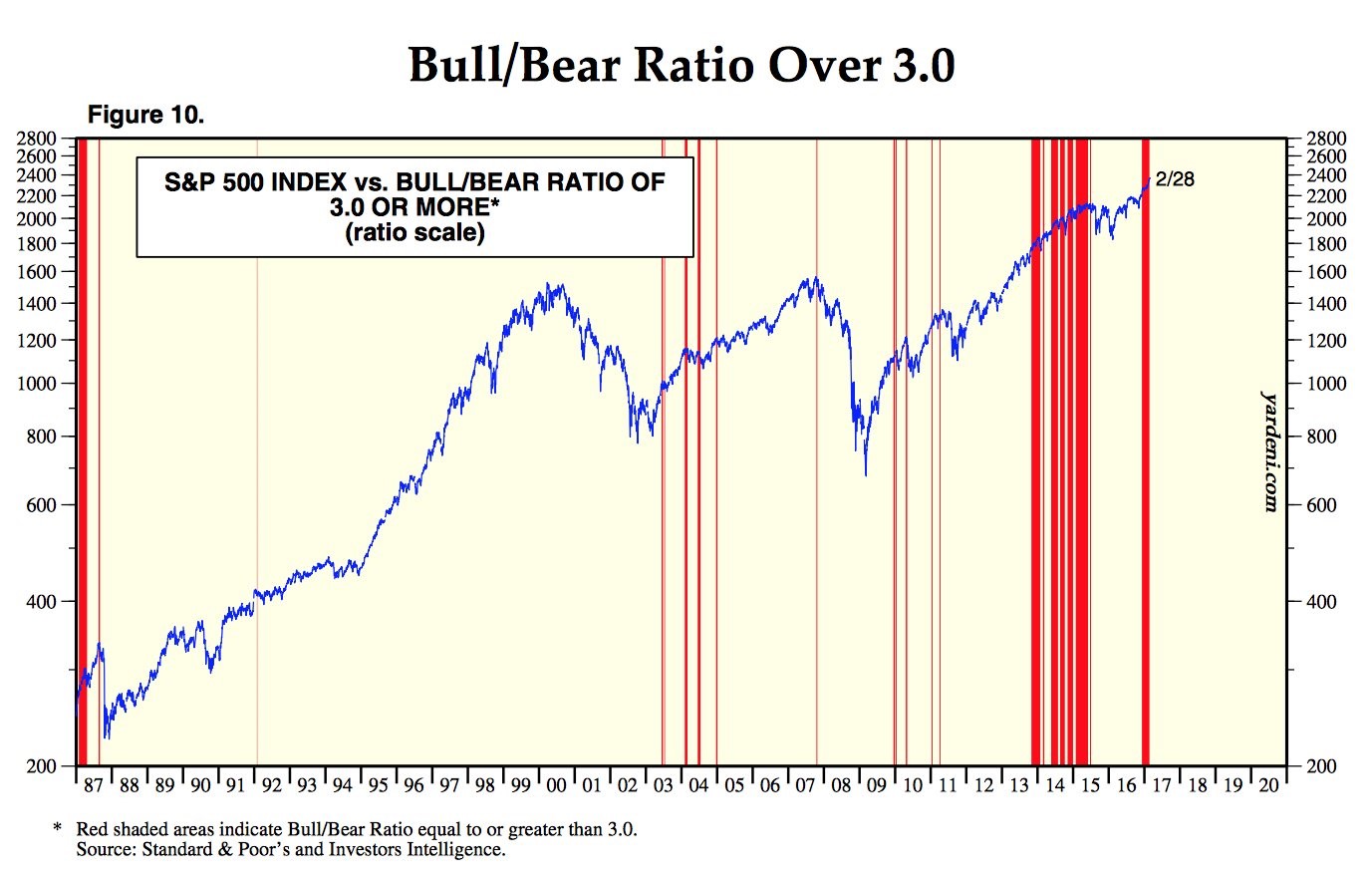

Another way to look at the reckless speculation in stocks is the bull to bear ratio. The chart below has a red line through the S&P 500 when the bull to bear ratio is above 3.0. The optimism is much greater than the beginning of the last bull market in 2003 as there are more red lines.

I don’t think speculators are looking at the chart below. It shows the Russell 2000’s enterprise value to EBITDA. It’s nearly double the bubble valuations of the late 1990s because the tech bubble was centered around a few technology stocks. This bubble is more broad based. This type of chart is why I have said we are living in historic times.

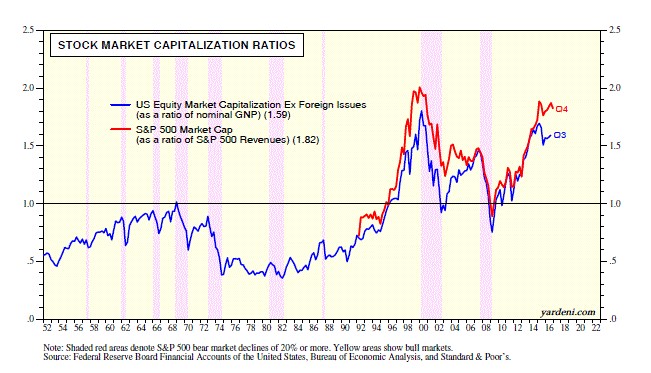

Other ways to measure the stock market are seen below. The U.S. equity market excluding foreign issues as a ratio of nominal GNP is near the bubble peak of the late 1990s. The S&P 500 market cap as a ratio to S&P 500 revenues is also near the high seen in the late 1990s. Bulls do not care about valuations. It’s why they buy stock in Snap which has more losses than revenues (absolute value).

The Fed is preparing to raise rates in March because inflation has been increasing. A big reason why inflation has moved higher is the base effect of oil prices rising. The Fed has been giving itself credit for a mission accomplished as inflation is approaching its 2% target. Inflation’s rise was caused by Trump’s election and oil price increases. This means the Fed’s policies to create inflation didn’t work. The only inflation it created was higher stock and bond prices. It’s dangerous that the Fed could be so wrong about its policies. The three valuation metrics I showed above are all at or near record highs because of the Fed’s balance sheet expansion shown in the chart below. The stock market is whistling past the graveyard as the Fed is threatening to take away the punch bowl.

Leave A Comment