Crazy Day On Wall Street

2018 has been nothing like 2017 as the market has whipsawed in the past few days. The Dow ended up 2.33% and the S&P 500 was up 1.74%. The S&P 500 was down to 2,624 at the lows and closed at 2,695. The Dow had a 1,167 point trading range. The Dow rose at least 2% and fell at least 2% from the previous close for the first time since December 5th, 2008. The VIX collapsed down 20.04% to 29.84. When the VIX was at 37 yesterday, it implied a 2% move every day for the next month. Interestingly, after the short volatility trades were blown out last night, the long volatility trades fell today. The XIV will be closed by Credit Suisse on February 21st. Google shows it was down 72.58% on Tuesday to $7.35. The SVXY was down 82.79% to $12.24. The total blow up of these ETNs cost investors almost $3 billion.

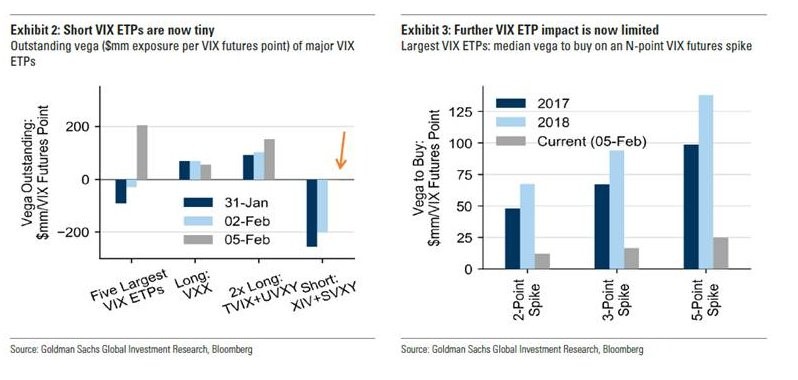

The charts below show the outstanding exposure per VIX futures point of the major VIX ETPs. As you can see, the exposure has been eliminated. It appears the effect on the market is over. Many were worried on Monday night about a crash in the market because the futures indicated the Dow would fall 1,200 points. The market opened down less than that and recovered in an up and down fashion. Some participants believe this was the stock market searching for and finding a short-term bottom. On Monday night, I was short-term bullish on stocks which paid off quicker than I expected. I’m now more neutral because of this huge rebound. I’m guessing the VIX will fall in the next few days as normalcy returns.

The rising interest rates will be a problem down the road, but won’t cause a crash like we saw in the past few days. This crash was more like the flash crash than the previous fundamental corrections and bear markets. It’s amazing to see asset prices fluctuate so quickly on no news. It’s unfortunate that many brokerage firms like Fidelity have had intermittent outages recently. There was no reason to panic. You should have raised cash in January when the market was going up in a straight line.

Leave A Comment