The Greed Is Palpable

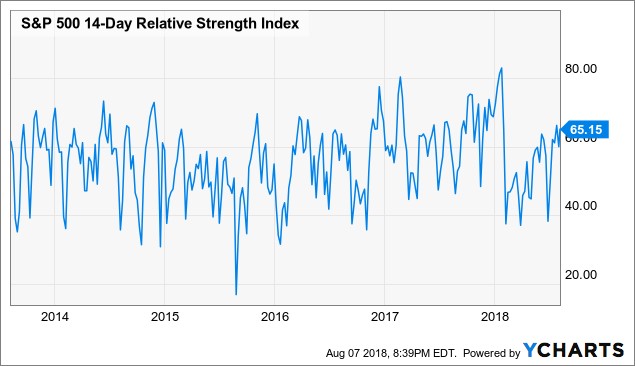

The S&P 500 was up 0.28% and the VIX was down 3.02% to 10.93 on Tuesday. The S&P 500 and Wilshire 5000 are less than 1% away from their record highs. Just as the market is getting close to its record high, it is also showing signs of excessive greed. As you can see from the chart below, the S&P 500’s 14 day RSI is at 65.15 which is nearing 70 which is considered overbought. The CNN Fear and Greed index is at 73 out of 100 which is 2 points away from the extreme greed category. There haven’t been many economic reports this week, so the economy can’t stop this run. The biggest economic report of the week is the July CPI report on Friday. Earnings season is finishing up strong.

The energy sector was the biggest winner as it was up 0.72%; the biggest loser was consumer discretionary which was down 0.57%. The financials have been on an amazing run; they are a key reason why the market is very close to breaking its record high. The XLF financials ETF is up 5.3% since July 13th. The most notable mover on Tuesday was Tesla. It was up 10.99% because the Saudi Arabia wealth fund announced it has invested $2 billion in the company and Elon Musk announced his intentions to take the company private at $420 per share.

10 Year Nears 3% Again

The 10-year yield increased from 2.9395% to 2.9730% in its latest attempt to get to the 3% threshold. There is a record short position in the 10-year bond, yet it still can’t stay above 3%. That’s remarkable given the strength in the economy and the increase in inflation. My point is that if the yield hasn’t gone up in that environment, it can only fall since growth is about to slow. The bearish argument on the 10-year is that the market has the yield set at a fundamentally wrong price which needs to be reevaluated. It’s tough to argue that growth will be higher than Q2 and inflation will get much higher. We’ll see on Friday if inflation can increase further. The 2-year yield went from 2.6452% to 2.6697%, meaning the latest 10-year 2-year differential is about 30 basis points.

Leave A Comment