Seemed appropriate…

All of a sudden, ‘stuff’ matters:

Powell hawkish

Trump lawyer resigns

Trump trade wars start

Funding market stress surges

Credit markets spike

Facebook new lows

Tech tax and regulation

The Dow dumped over 700 points on massive volume, broke below it 100DMA to its lowest since Feb 9th… and lowest close since February 8th’s crash lows…

Well that re-escalated quickly…

Chinese tech stocks tumbled…

European stocks were ugly (UK’s FTSE at lowest since 2016)… after the worst PMI in 14 months…

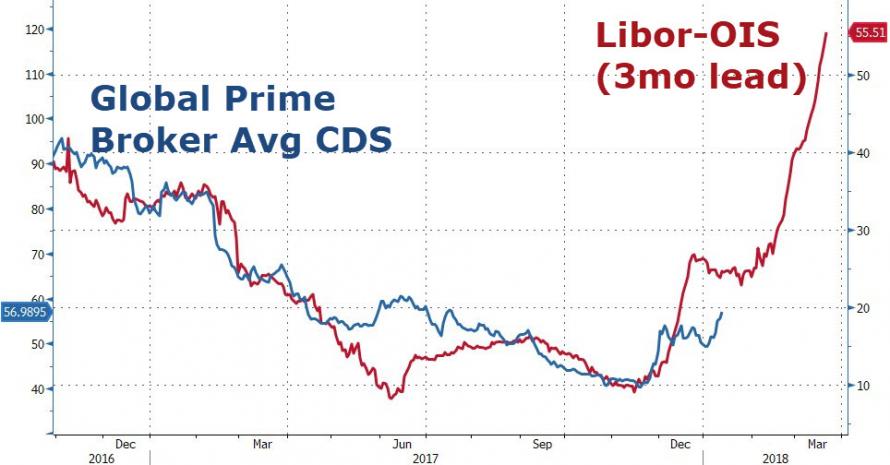

As funding market stress ripples through the credit markets (bank credit at 6-month wides) and on into the equity markets…

US and EU banks are tumbling…

And as the cost of funding soars so buybacks will diminish…

So US Stocks suffered heavily…

Futures show the various legs lower as trade war announcements overnight, European open, US open, trade war news, Mueller news, and credit crashing sent stocks lower…

VIX spiked back above 23 – its highest since March 2nd…

The Dow broke below its key triangle support and the Fib 38.2% retrace again today…

The S&P 500 broke and closed below its 100DMA…

Bloomberg notes that equities are more or less in free-fall mode now as the closing bell nears, with the S&P 500 tumbling 2.3% as I type. Whether you believe it’s trade tensions causing the drop or (like Bill Gross) think it’s fallout from Jay Powell’s press conference debut, the question is where will it stop? Chart guru Bill Maloney on the Squawkbox has these levels penciled in as possible areas of support: the first is 2,647, the March 2 low. Next up is the Feb. 5 low of 2,638. Below that is the 200-day moving average around 2,584. That is, of course, if the market respects technicals, which is no guarantee when trading gets like this…

Leave A Comment