Last week some feared a trade war, a recession, and a bear market. This week all of that has been forgotten as the S&P 500 was up 0.45% on Thursday which was the day of the tariff announcement.

President Trump announced that a 25% tariff on steel and a 10% tariff on aluminum would be levied in the next 15 days. Canada and Mexico will be excluded while NAFTA changes are being negotiated. Other countries feel they deserve to be exempt as well. Trump shined a positive light on Australia because America has a trade surplus with it. The more exemptions the better, as trade will grow quicker without tariffs. The most shocking report, which counteracts everything we heard last week, was that all countries are invited to negotiate exclusions from the metals tariffs.

For the first time during Trump’s presidency, Wall Street feared the rhetoric in the media as stocks sold off. In 2017, many people complained that stocks never declined when a political storm took place. Now we know why stocks don’t normally have big reactions to political news. There’s usually a lot of exaggerated bluster before action, which isn’t that extreme, takes place. Politicians generally act at a snail’s pace as evidence by the fact that the Brexit still isn’t complete.

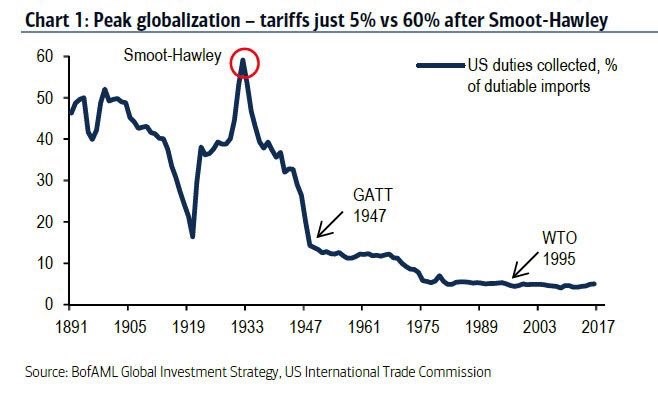

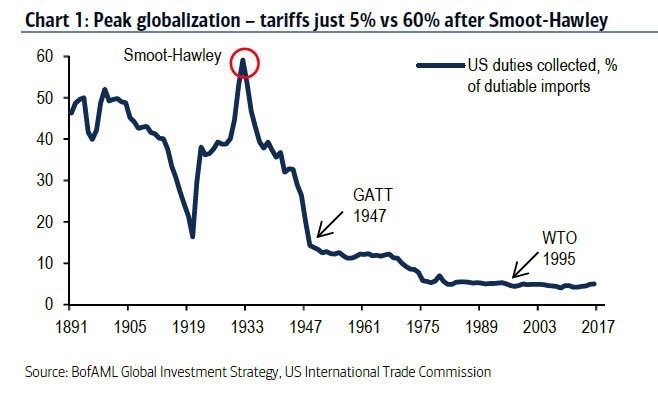

The chart below really fires home the point that the tariff fears were irrational. As you can see, the Smoot-Hawley tariffs were near 60% while they are near 5% now. A small increase shouldn’t be compared to Smoot-Hawley. The main reason people made that comparison is because it’s the last time tariffs went up. However, it’s the equivalent of comparing the February correction to the financial crisis.

Call For A 40% Crash Dominates Chatter

I like to discuss the topics investors are focused on to give clarity on the latest news events. Usually the focus is on what policy makers are doing or the latest economic data, but sometimes it’s a market call. The market call, which was one of the top stories in the financial press on Thursday, was JP Morgan’s co-president Daniel Pinto’s forecast that a 20%-40% decline could occur in the nest 2-3 years. He then said a recession in late 2019 was possible. This is essentially my call because it looks like the yield curve will invert in the next 12-18 months.

Leave A Comment