Photo Credit: Holy Smokes! Pham (Flickr)

We’ve previously shown that companies with consistently high returns on invested capital (ROIC) are stocks that are able to withstand market downturns, especially bear markets like the market crash of 2008. With 2016 providing many investors angst and concern that a bear market or market crash may be just beyond the corner, it’s important to focus on companies with strong fundamentals.

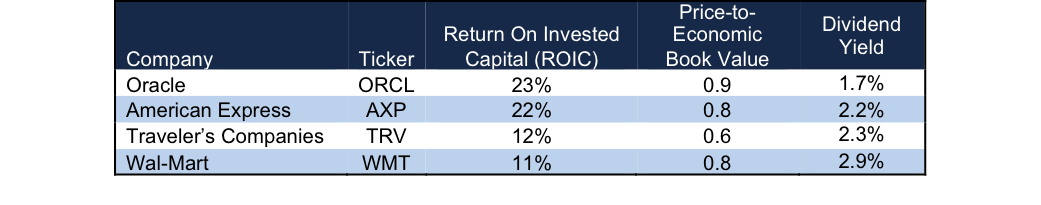

It’s time to look beyond technical price movements, earnings estimates, or analyst opinions. The reconciliation between cash flows and valuations has arrived. The market is beginning to distinguish between those companies that earn a quality ROIC and those that do not. Figure 1 identifies four companies with strong ROICs that we believe investors can turn to in a turbulent market.

Add in an impressive dividend yield and these stocks could be the difference between a portfolio that outperforms and one that doesn’t.

Figure 1: Stocks To Hold Through A Bear Market

Sources: New Constructs, LLC and company filings

Oracle (ORCL –$35/share – Very Attractive rating)

Our appreciation for Oracle as a business dates back to April 2013, when we first highlighted its merits as a value investment. While investors have become increasingly short-term focused (on all things cloud and in general), they fail to recognize the quality business Oracle has built.

Over the past 17 years, Oracle has grown after-tax profit (NOPAT) by an impressive 18% compounded annually. Throughout this time, the lowest return on invested capital (ROIC) Oracle earned came in 2009, but was still 22%. Oracle currently earns a top quintile ROIC of 23%. Oracle’s lead in database software allowed it to build a cash generating business, one that has generated nearly $41 billion in NOPAT over the past five years. Such large cash resources allow Oracle to take its time transitioning to cloud services and ensure the company “gets it right,” which is a luxury smaller competitors don’t possess.

Leave A Comment