We have ample enough evidence for the efficacy, or inefficacy really, of tax cuts as fiscal stimulus. They have been deployed numerous times all over the world the last ten years, and the results have been nearly identical in all. Most charitably, proponents have been left with some form of “jobs saved” to describe, counterfactually, how if they had not been undertaken things would have been worse. That’s not stimulus, it’s distraction.

The same goes for fiscal spending, particularly based on raised budget deficits which in the Economics textbook is Chapter 1 on dealing with the business cycle.

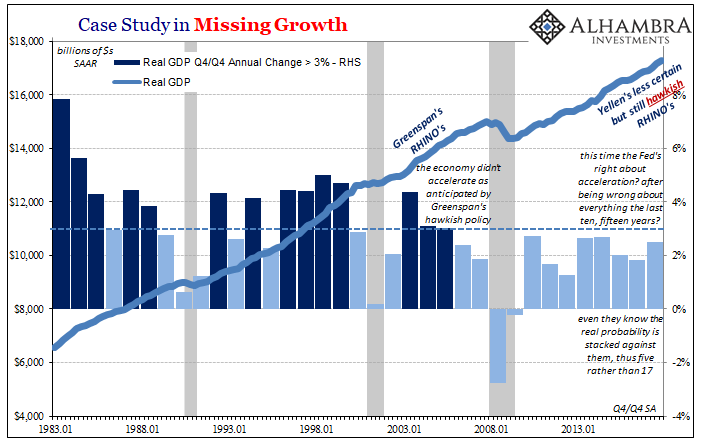

The current inflationary boom narrative therefore rests in large part on what’s different this time as compared to those previous (the remaining balance of the idea is attributed to the Fed’s fingers crossed strategy that amounts to faith in just random good luck plus time). President Trump’s corporate tax reform enacted just before yearend last year has left inside it a lot if not all of these residual hopes.

Not only was the corporate tax rate reduced substantially, contained within it was a one-time tax holiday for firms interested in repatriating “stranded” foreign income. The intent is straightforward and even intuitive – the return of funds (already vested in dollar assets if in accounts domiciled abroad) is meant to spur capex as well as wages. We’ve heard quite a bit about the latter, though in anecdotes rather than data (and in the form of, so far, one-time bonuses to employees, not broad-based and permanent advances in pay, not that bonuses are in any way a bad thing).

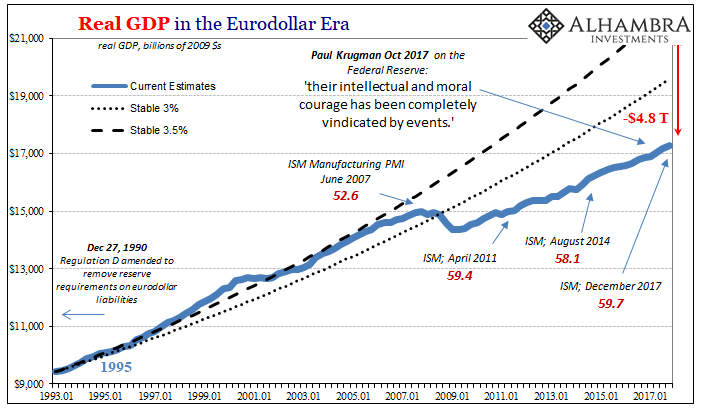

In terms of economic analysis, if there is to be any lasting positive contribution from tax reform, it must follow through productive investment. It’s the one glaring omission from this economy, detached from the intended and expected “recovery” by liquidity preferences. From the view of the corporate boardroom, it is far less of a risk to invest in one’s shares than one’s real economy facilities. The reason is equally simple; the stock market goes up, the economy does not.

Leave A Comment