(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 14.9%

T2107 Status: 14.9%

VIX Status: 23.1 (ranged from 20.4 to 27.2)

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #14 under 20%, Day #17 under 30%, Day #33 under 40%, Day #37 below 50%, Day #52 under 60%, Day #393 under 70%

Commentary

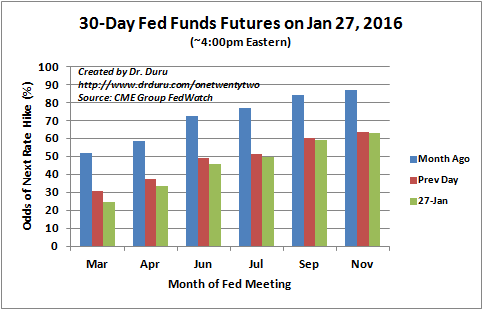

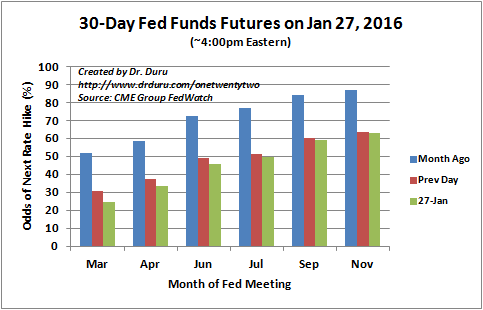

The Federal Reserve delivered the perfect “no new news” statement. It defied my expectation for delivering something substantial relative to the current context of market volatility. Media outlets of course tried to make headlines out of the Fed’s latest pronouncements on monetary policy, but fundamentally, nothing changed. The Fed reiterated its data-dependent approach to normalizing rates at a snail’s pace. It was a stalemate kind of day as a result. Notably, the trend pushing out the date of the next rate hike continued: September is now the first month where the odds go above 50%. Media outlets that claim the Fed’s statement keeps a March rate hike in play are off-base.

The market now expects the first rate hike in September.

Source: CME Group Fedwatch

SPDR Gold Shares (GLD) is following the momentum in rate expectations: the further the push-out, the higher GLD goes…for now.

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), nudged downward to 14.9% after ranging from 13.1% to 17.7%. At one point, the S&P 500 (SPY) was making a breakout move at its highs -an end to the oversold period seemed near. Instead, the index closed down 1.1% to stay within a tight 4-day trading range of alternating up and down days.

Leave A Comment