Chinese stocks soared higher this week (SHCOMP +4.3%) – the best week since March 2016…

While China surged in two major National Team pumps, Europe was a one-way-street of stock-love all week…

But US markets were a little more mixed with The Dow leading, S&P holding gains, and Nasdaq, Small Caps, & Trannies all red…

It was quad-witch today, and a massive index reclassification, which prompted yuuge volume in stocks…the biggest NYSE Volume Day since July 2010…

On the day, The Dow trod water rather too calmly as the rest of the market rolled over…and some serious moves into the close…

Nasdaq broke back below 8,000…

Dow (blue) leads the way in September (+3%) as Small Caps (red) and Nasdaq (green) remain in the red…

US still leads the world on the year…

FANG Stocks ended lower on the week

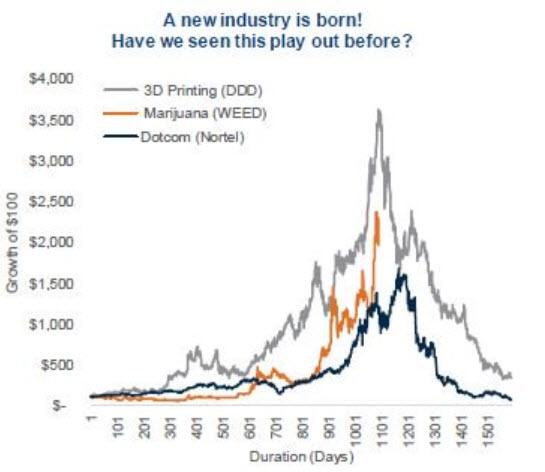

Making headlines all week were the weed-stocks, as Tilray exploded higher and crashed back to earth, but the broader cannabis market (ETF MJ), had a big week…

But it’s not a bubble…

Ahead of today’s major index reclassification, the S&P Tech sector ETF (XLK) saw an unprecedented inflow (at a time when heavyweight tech growth stocks like FB and GOOGL are about to be removed from it)…

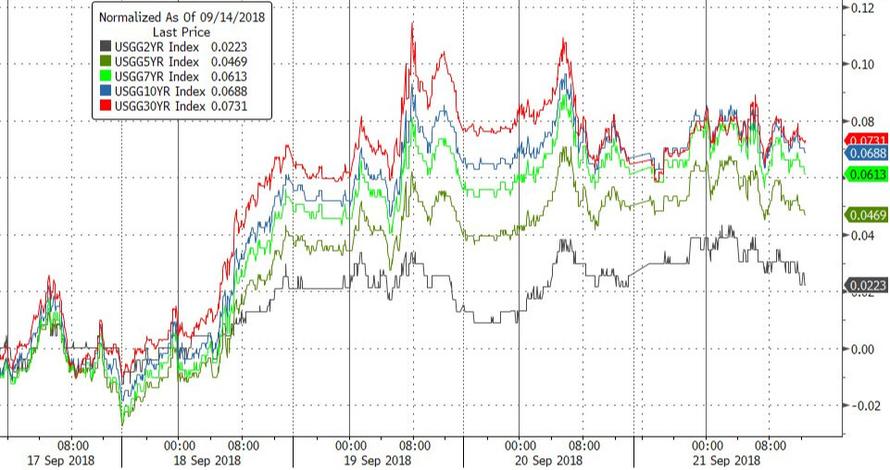

Treasury yields rose for the 4th week in a row (longest losing streak since Feb)…

The yield curve steepened on the week (but was well off its steepest levels by the close)…

Notably after Tuesday’s major surge in yields – back above 3.00%, 10Y Yields have largely trod water in a very narrow range…

But 10Y remains off 2018 yield highs for now…

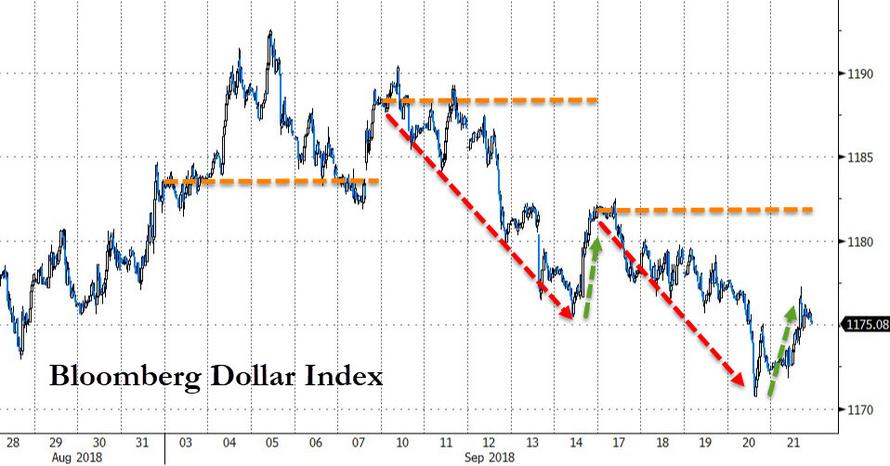

The Dollar Index fell for the second straight week – the biggest two-week drop since January…

NOTE – this week played out almost exactly like last week from a price-pattern perspective

Leave A Comment