Most Americans stop celebrating “half birthdays” back in grade school. The two most important birthdays in financial planning, however, are half birthdays long past that age: 59½ and 70½. Reach the first, and the IRS give you a gift: penalty-free withdrawals from your IRAs and 401k’s. Reach the second, and the IRS give you another: Required Minimum Distributions (RMDs). This gift, however, may not be the pretty package it seems at first. Many fear these forced distributions will increase their tax rate over time. Is this true? We crunched the numbers, and it turns out that in many cases, there’s nothing to worry about.

What Are RMDs?

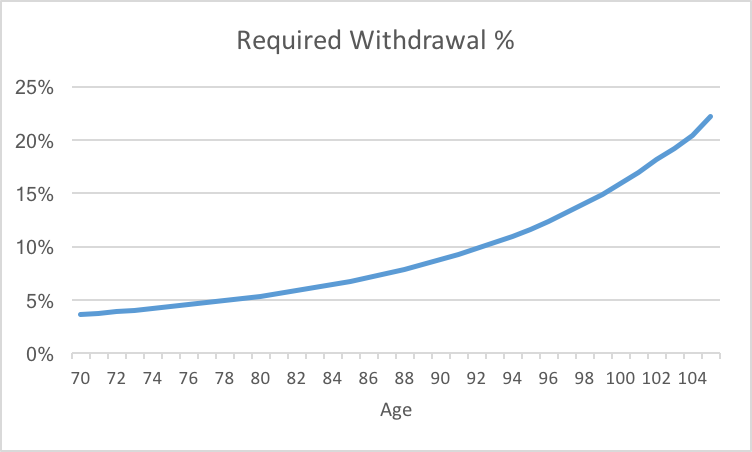

RMDs are an annual amount people are required to withdraw from their tax-deferred accounts when they are older than 70. The most common of these are traditional 401ks and IRAs. The government incentivizes people to save for retirement by providing tax deferral in these accounts; however it doesn’t want this deferral to last forever, so it requires us to take out money, starting in the year we turn 70 ½. The required withdrawal amount is a percentage of the account, and increases with age, starting at about 3.5% at age 70:

As with any funds withdrawn from tax-deferred accounts, RMDs are considered taxable income, so withdrawing these funds will increase the income reported on your tax return. There’s the fear that RMDs will increase your income so much, you will be in a higher tax bracket, and must pay higher taxes as a percentage of that income.

The 10%+ of your IRA balances added to your income in later years seems daunting, but there are actually two factors mitigating the impact of this increase. First, the required annual distributions hinder the growth of the account value, so that it does not balloon over time. By taking your RMD in one year, you are decreasing the account balance relative to what it would have been if you didn’t take one. The effect is small year-to-year, but compounds significantly over time.

Leave A Comment