Technology giant Apple (AAPL – Free Report) is set to release fourth-quarter fiscal 2018 results on Nov 1 after market close. Since Apple accounts for more than 19% of total market capitalization of the entire technology sector in the S&P 500 Index, it is worth taking a look at its fundamentals ahead of its quarterly results.

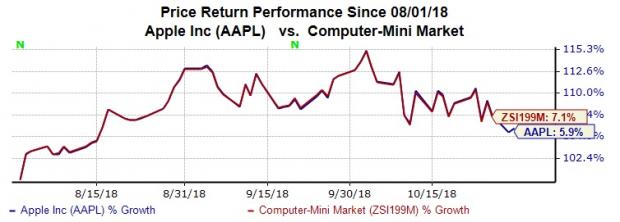

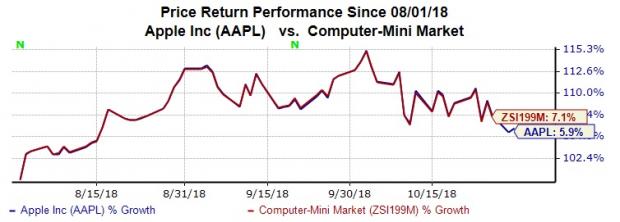

Apple has returned about 5.9% over the past three months, underperforming the industry’s rally of 7.1%. The momentum is expected to continue as the company is likely to beat estimates in the soon-to-be-reported quarter.

Inside Our Methodology

Apple has a Zacks Rank #3 (Hold) and an Earnings ESP of +1.35%. According to our surprise prediction methodology, the combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 and a positive Earnings ESP raises the possibility of a beat. A Zacks Rank #4 (Sell) or 5 (Strong Sell) stock is best avoided going into the earnings announcement, especially when the company is seeing negative estimate revisions. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Apple has seen positive earnings estimate revision of a couple of cents over the past seven days for the fiscal fourth quarter. Analysts raising estimates right before earnings — with the most up-to-date information possible — is a pretty good indicator for the stock. The company also has strong track record of positive earnings surprise. It delivered an average positive earnings surprise of 5.46% in the trailing four quarters. It is expected to post substantial earnings growth of 34.78% and revenue growth of 16.95% in the fiscal fourth quarter. Though AAPL has a solid Growth Score of B, its Value and Momentum Score of C each is disappointing. The stock belongs to a top-ranked Zacks Industry (top 43%).

According to the analysts polled by Zacks, Apple has an average target price of $237.91 with more than half of the analysts having a Strong Buy or a Buy rating ahead of its earnings. This indicates nearly 11.5% upside to the current price of AAPL.

Leave A Comment